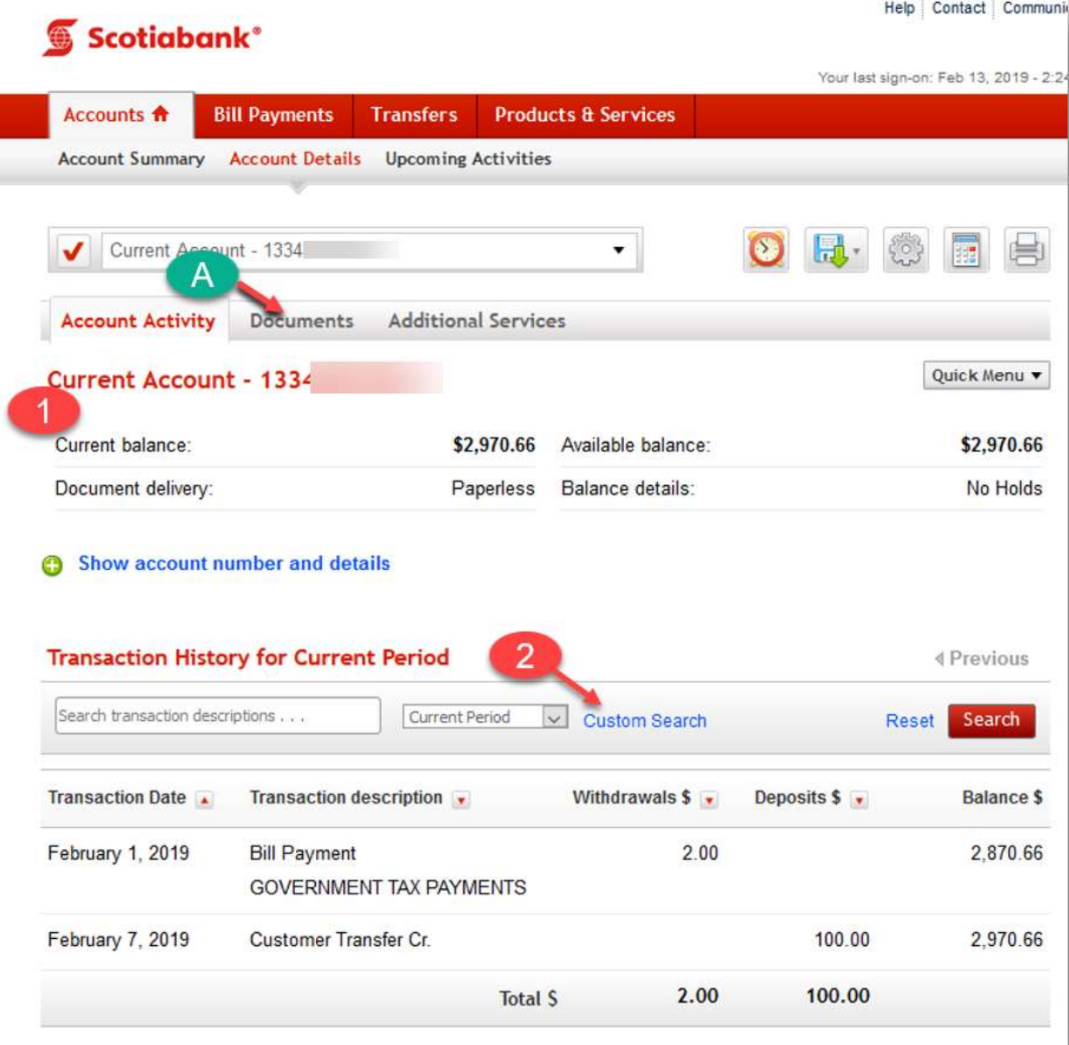

How to Save and Print Online Statements on Scotiabank in PDF Format

- Navigate to the Accounts tab and choose the desired bank account

- Click on “Documents” to access the download options

- Specify the time periods for the statements you wish to download

- Begin downloading the statement for each month selected

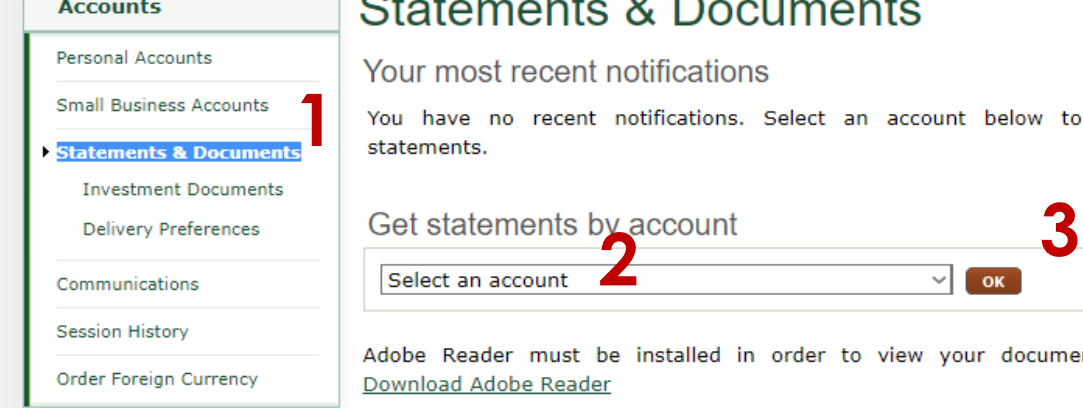

How to Save and Print Online Statements on TD in PDF Format

Step 1:

- Click on Statements & Documents

- Select the account you want to download

- Click OK

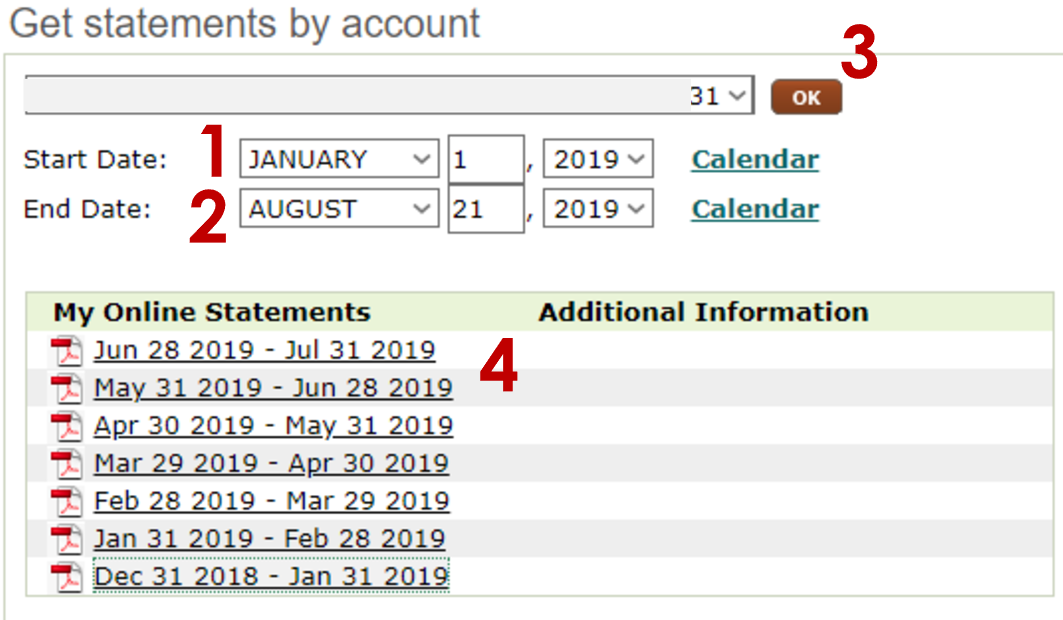

Step 2:

- Select Start Date

- Select End Date

- Click OK

- Click on Statements to download

How to Download RBC Bank Statements in Excel Format

The steps below are for desktop only, not the mobile app.

Step 1:

Sign in to your RBC business account using a browser, then click the account link

Step 2:

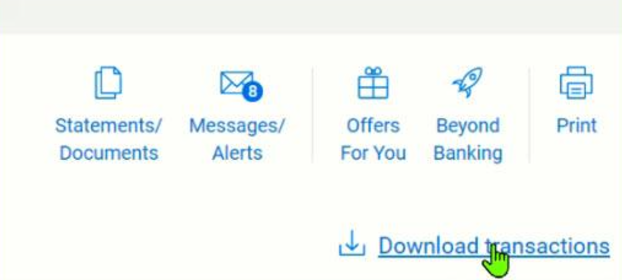

Click “Download Transactions”

Step 3:

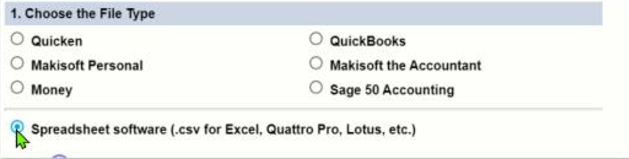

Select “Spreadsheet Software”

Step 4:

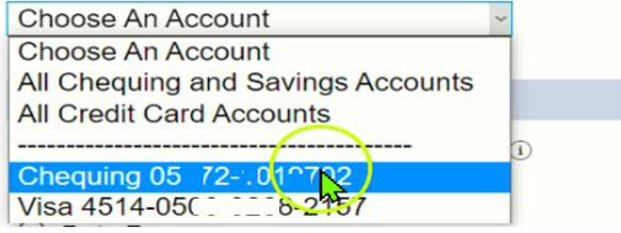

Pick an account you wish to download

Step 5:

Select Date Range and click “Download”

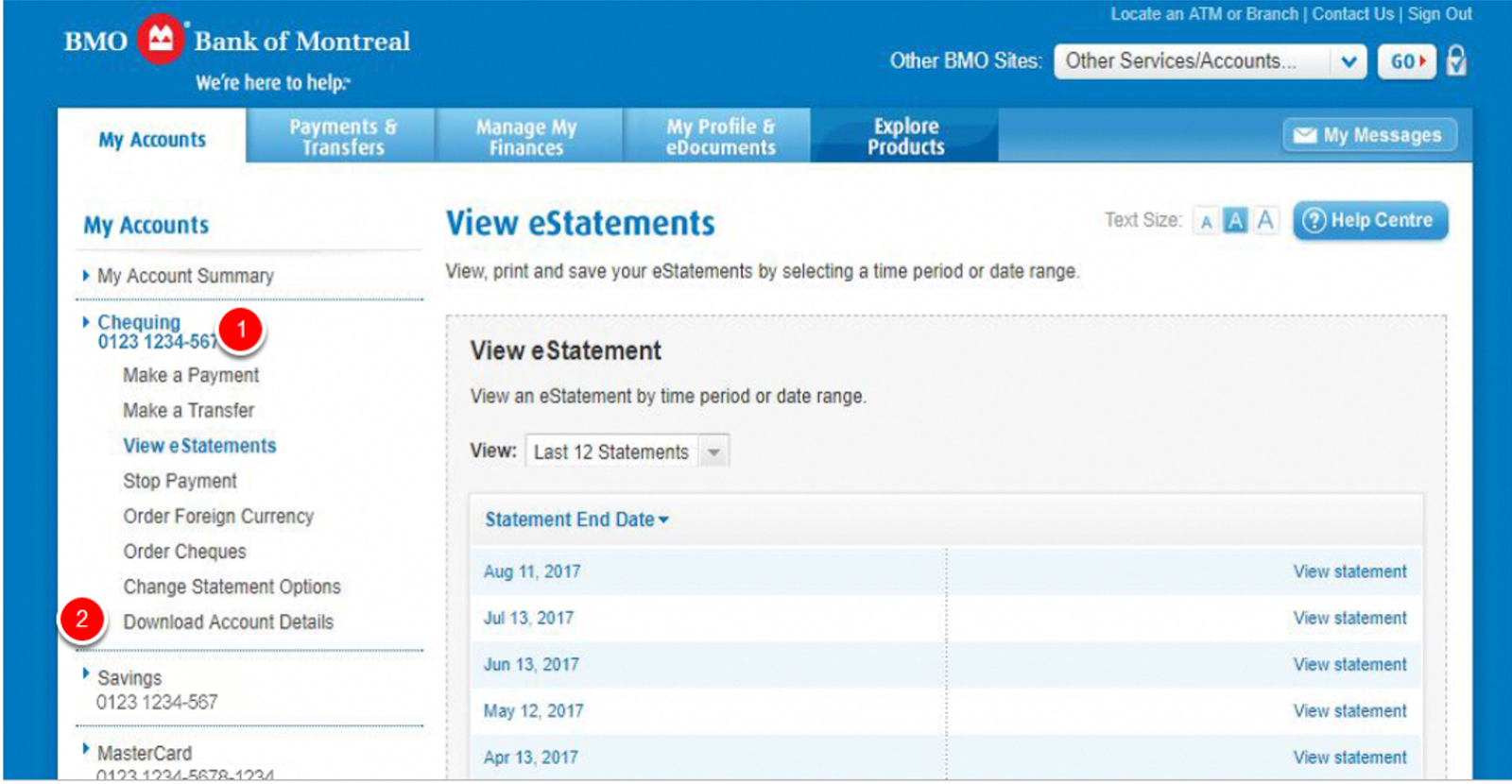

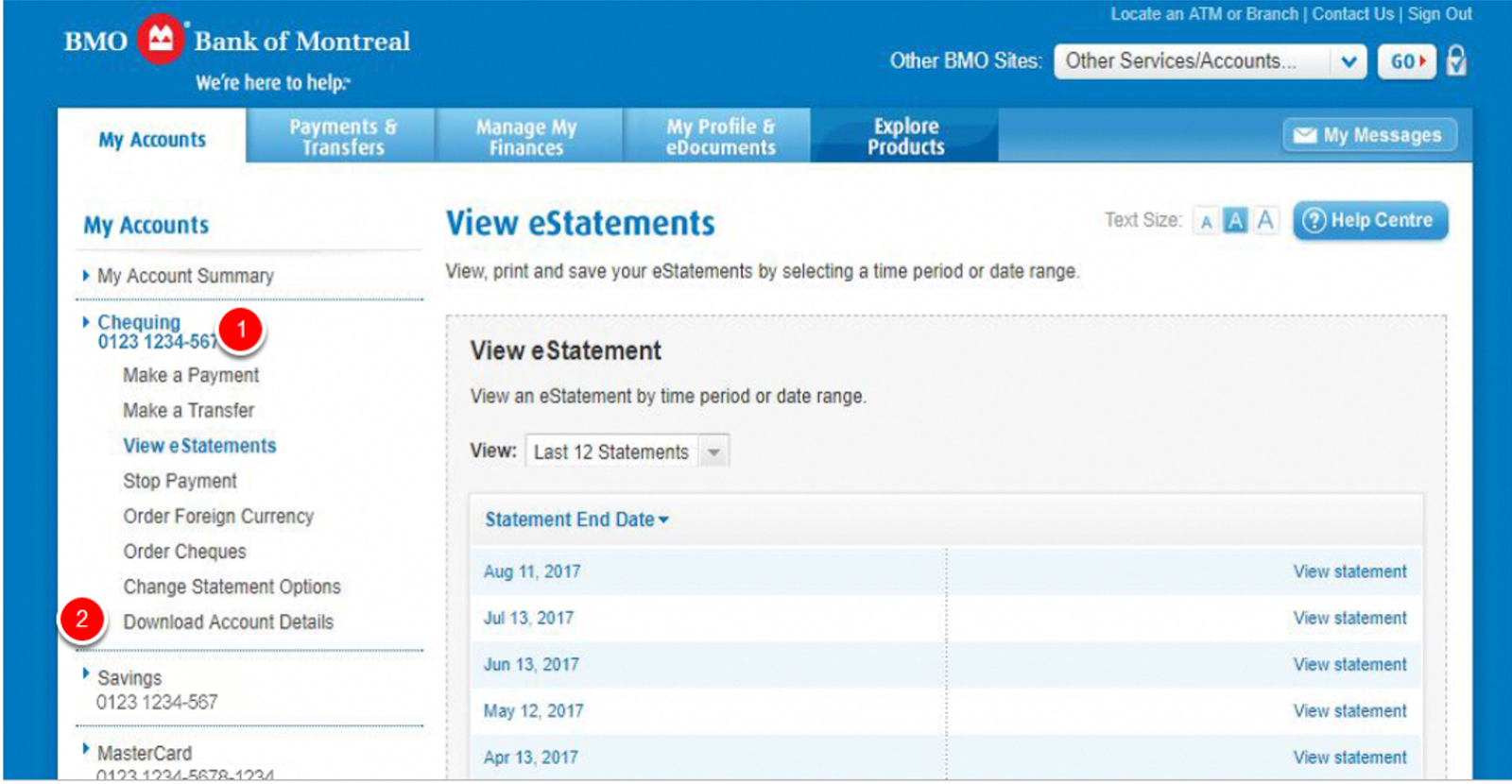

How to Download BMO Bank Statements in Excel Format

- Click on My Accounts tab then select your account

- Select Download Account Details

- Check the box beside the account you wish to download

- Select “Transactions in the following date range” and enter the “From” and “To” Dates

- In the format section select “Spreadsheet (CSV format)”

- Click continue and download

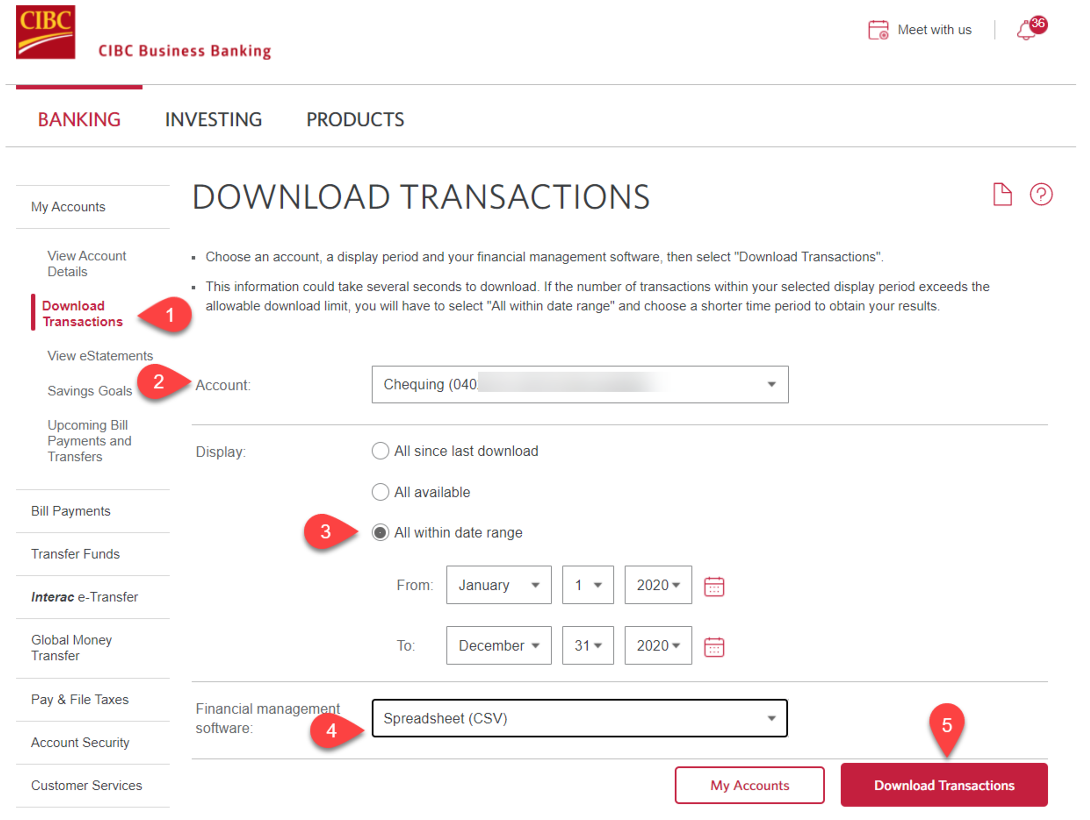

How to Download CIBC Bank Statements in Excel Format

The steps below are not available on the CIBC Mobile App. Login to your corporate business account with CIBC using a browser.

- In the My Accounts menu on the left, click on Download Transactions

- Pick the account you want to download

- In the “Display” section, select All within Date Range Choose Month, Day and Year from — To period.

- In the “Financial Management Software” section, select Spreadsheet (CSV)

- Click download

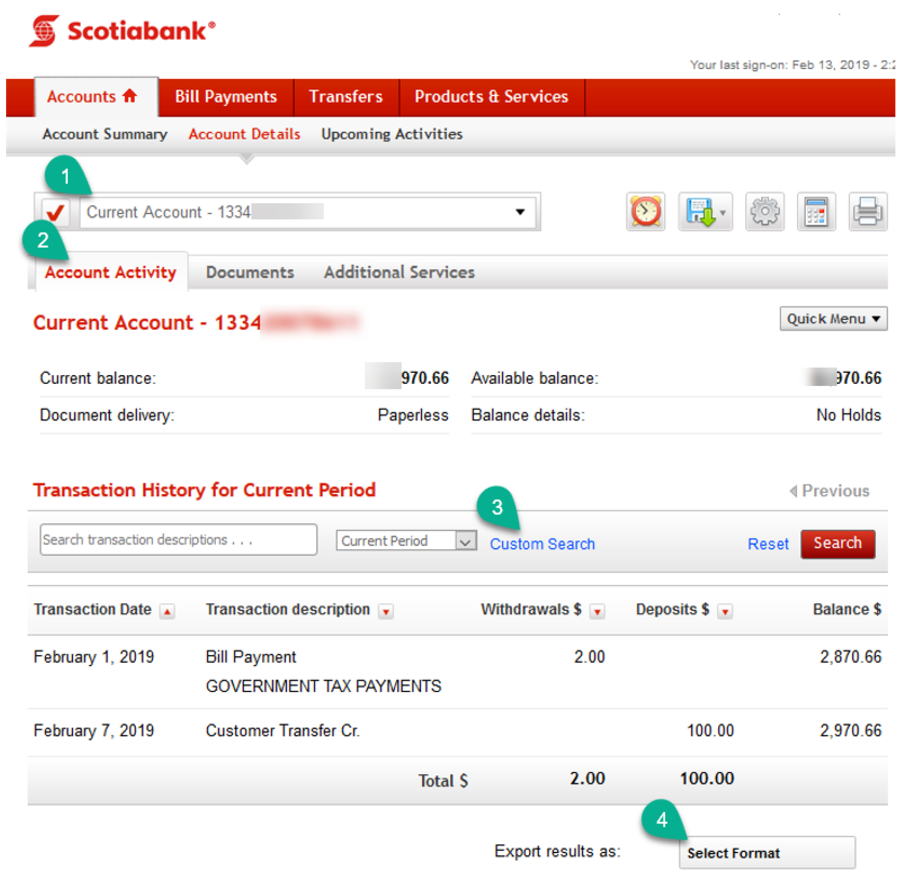

How to Download Scotiabank Bank Statements in Excel Format

The steps below are not available on the Scotiabank Mobile App.

- Click the Account Activity tab

- Click on the Custom Search link, then select Date Range and Choose Month,

- Click on the Custom Search link, then select Date Range and Choose Month, Day, and Year from — To the period you wish to display.

- Scroll down to the bottom of the page. In the “Export Result As” section, select Microsoft Excel

How to Download TD Bank Statements in Excel Format

The steps below are not available on the TD Bank Mobile App.

- Pick the account to want to download transactions

- Click the + sign next to Search by Month to show the date range

- Click Search

- Scroll to the bottom of the page and Select Spreadsheet (CSV)

- Click Download

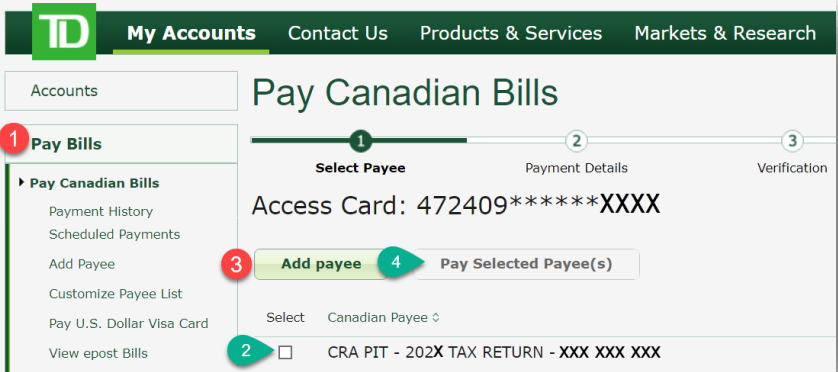

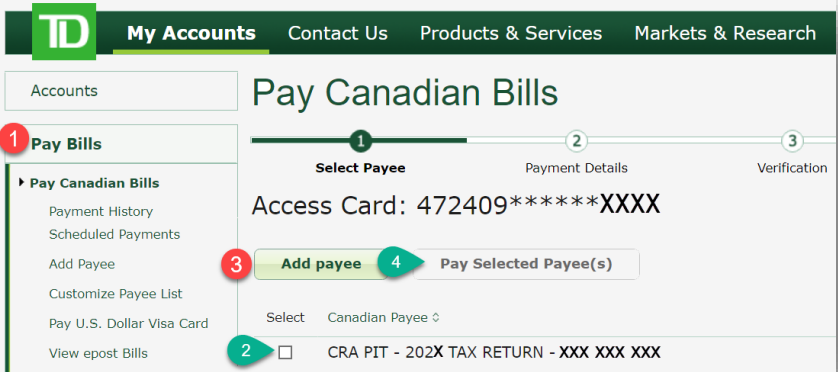

How to Pay Personal Tax Using Online Banking

Step 1:

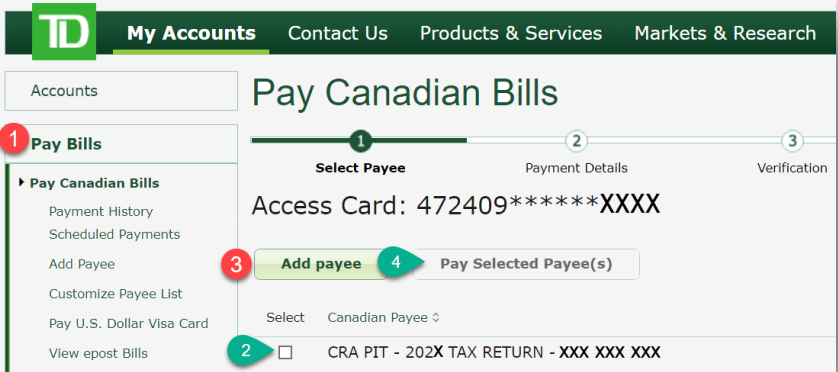

Sign into your TD banking service

- Click Pay Bills

- If CRA PIT - 202X is listed, select it and click “Pay Selected Payee.” And go directly to step 4 of this guide

- If not listed, click “Add Payee,” and follow Steps 2 and 3 of this guide

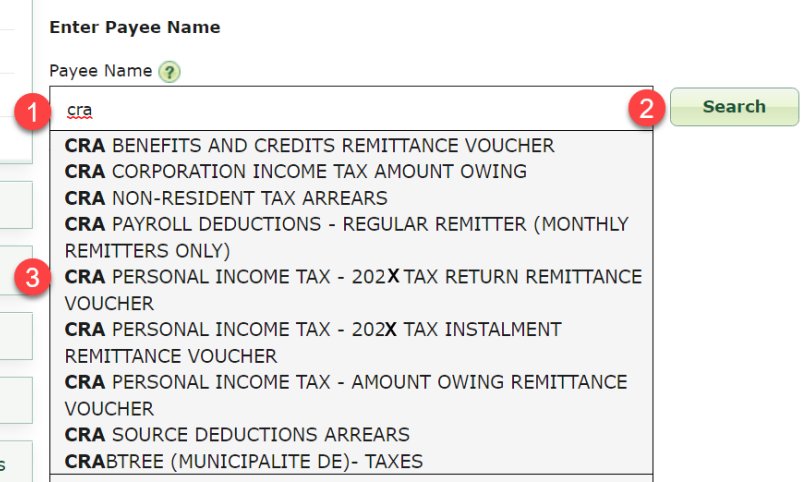

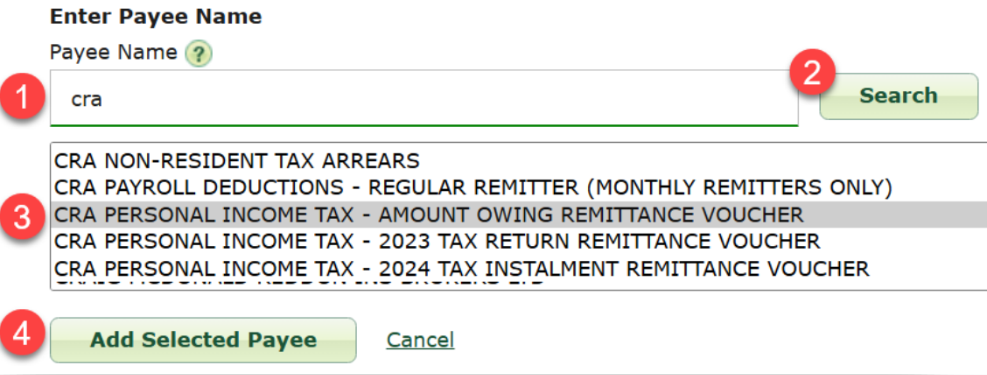

Step 2:

Click “Pay Selected Payee” as shown in 4 above.

- Type “cra” in the Payee Name search bar

- Click search

- Select “CRA PERSONAL INCOME TAX - 202X RETURN REMITTANCE VOUCHER”

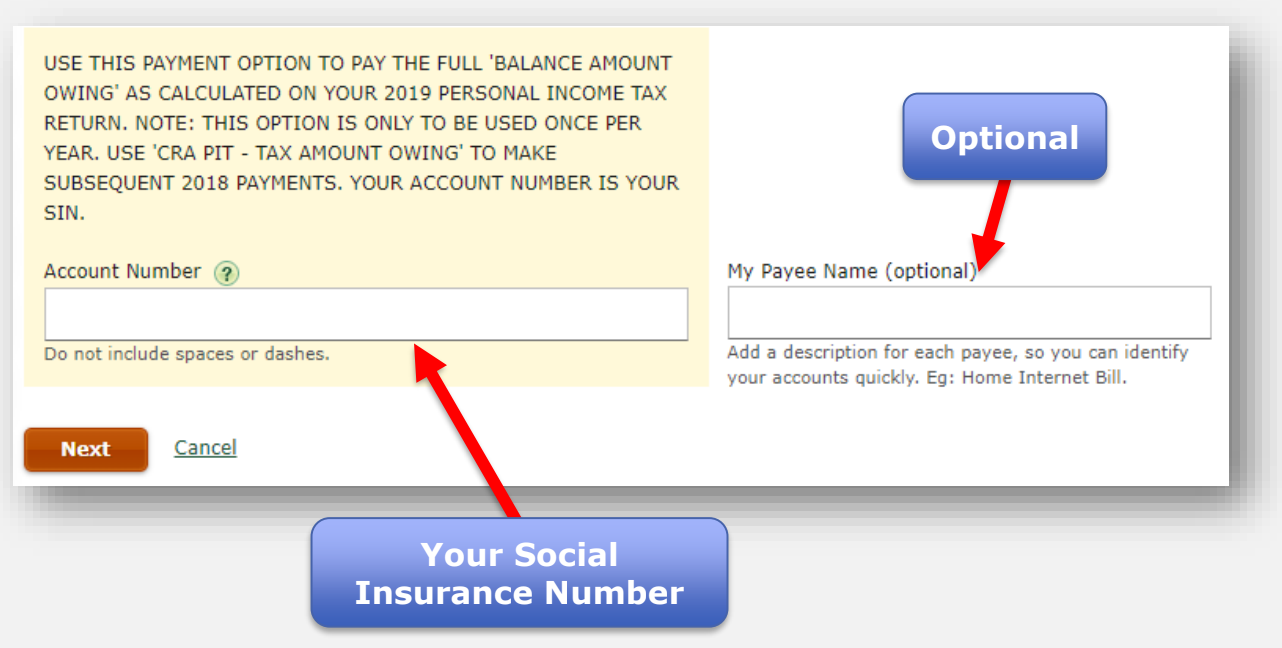

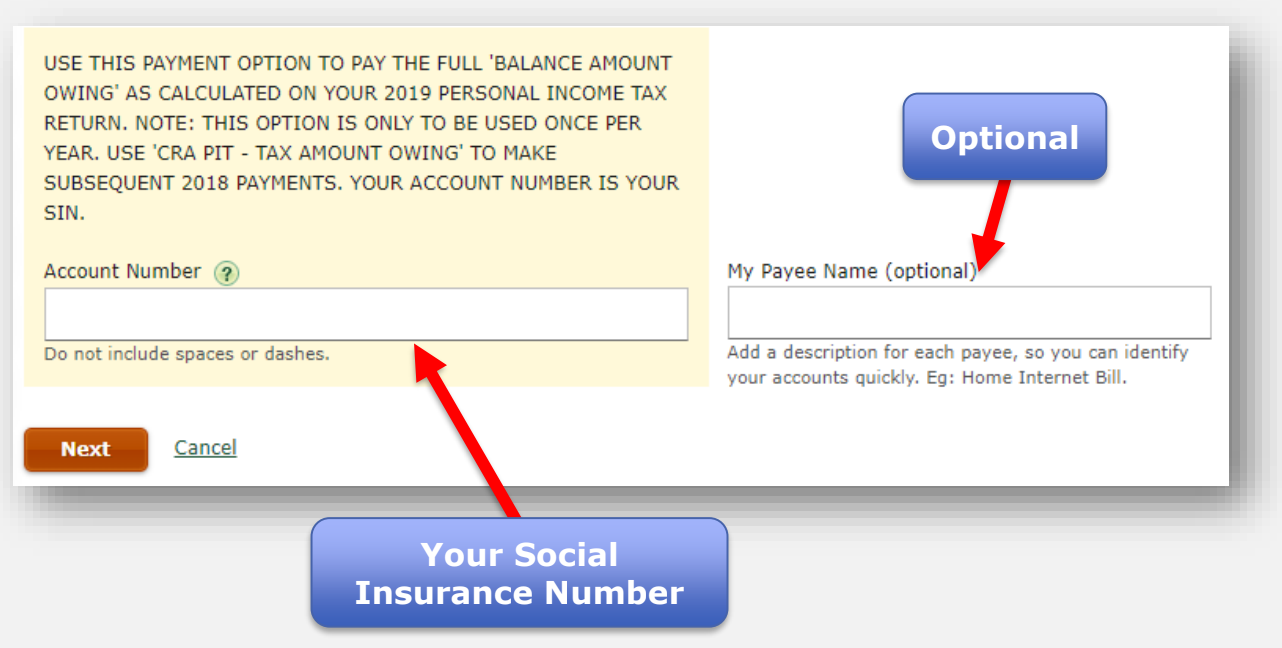

Step 3:

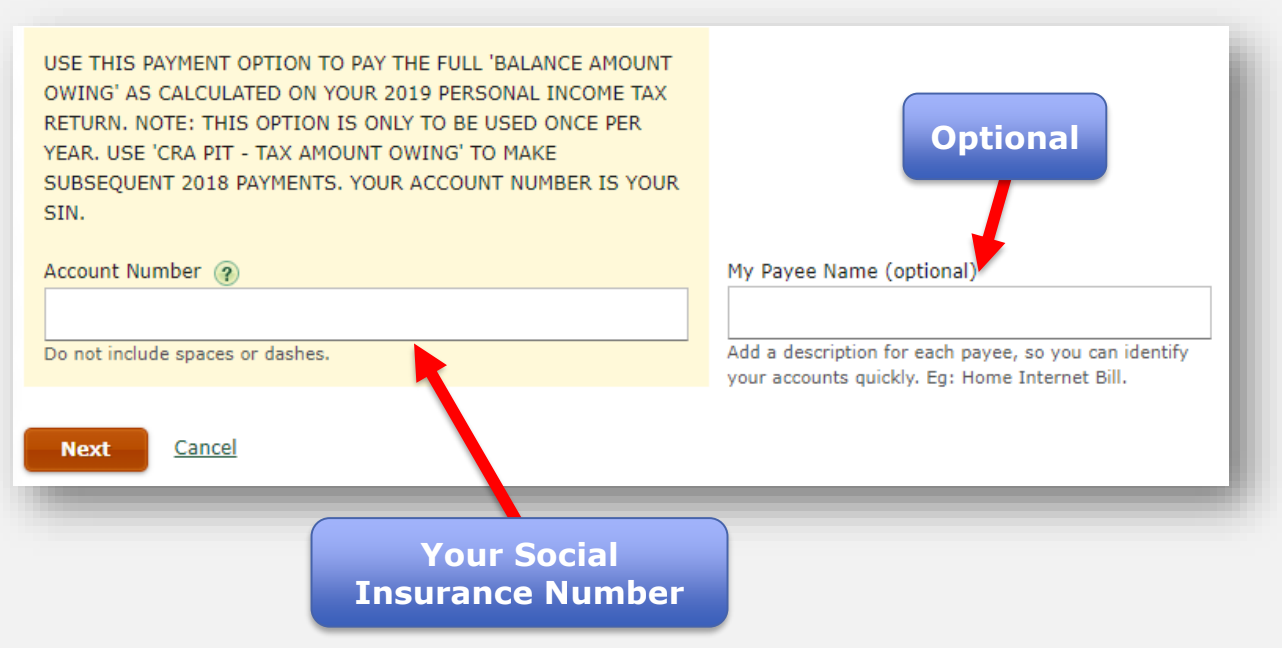

Enter your Social Insurance Number in the “Account Number” bar. You do not have to fill in “My Payee Name”

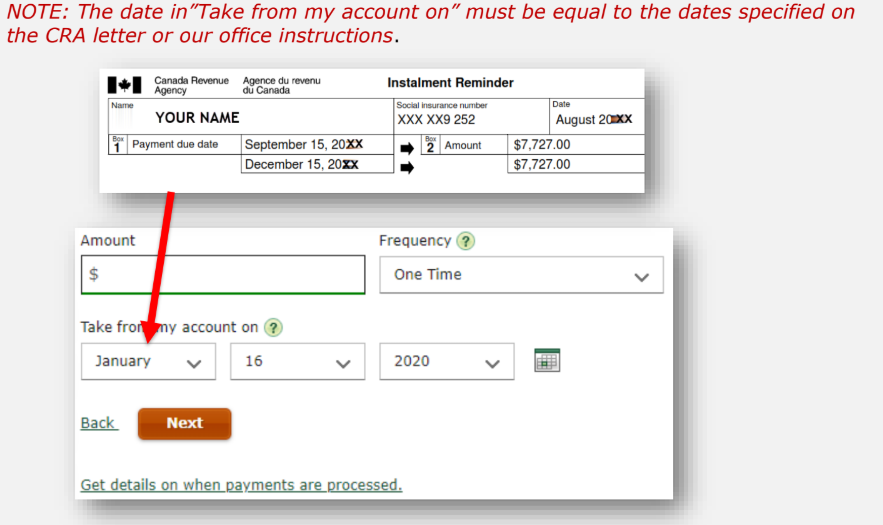

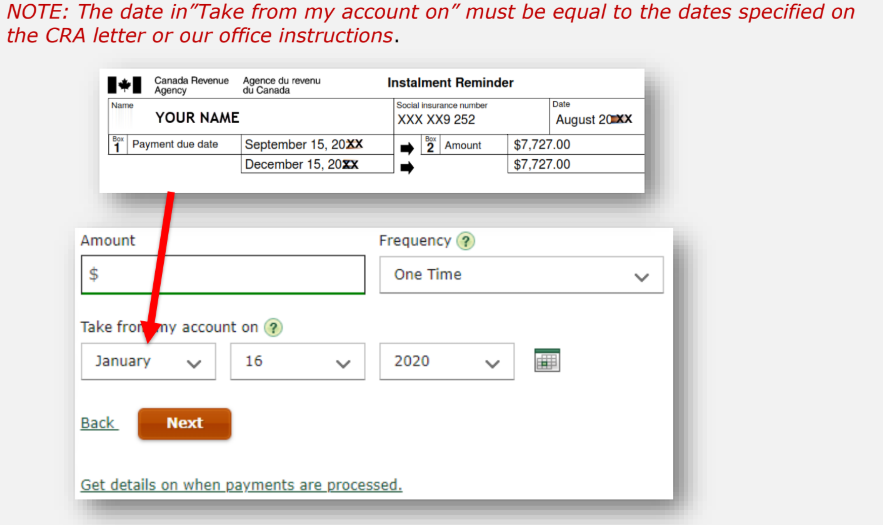

Step 4:

- Click “Finish”

- Fill in the information below

- Click “Next”

Step 5:

Print payment confirmation as pdf and save

How to Pay Personal Tax in Installments Using Online Banking

Step 1:

Sign into your TD banking service

- Click Pay Bills

- If CRA PIT - 202X is listed, select it and click “Pay Selected Payee.” And go directly to step 4 of this guide

- If not listed, click “Add Payee,” and follow Steps 2 and 3 of this guide

Step 2:

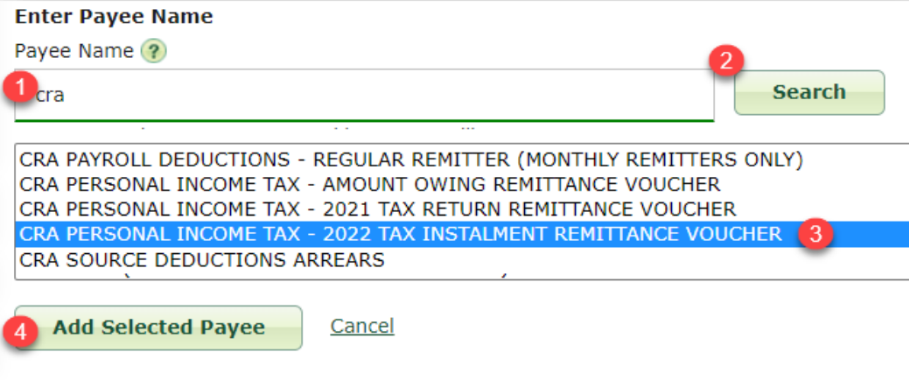

- Type “cra” in the Payee Name search bar

- Click “Search”

- Click “CRA PERSONAL INCOME TAX - 2022 TAX INSTALLMENT REMITTANCE VOUCHER”

- Click “Add Selected Payee”

Step 3:

Enter your Social Insurance Number in the “Account Number” bar. You do not have to fill in “My Payee Name”

Step 4:

- Click “Finish”

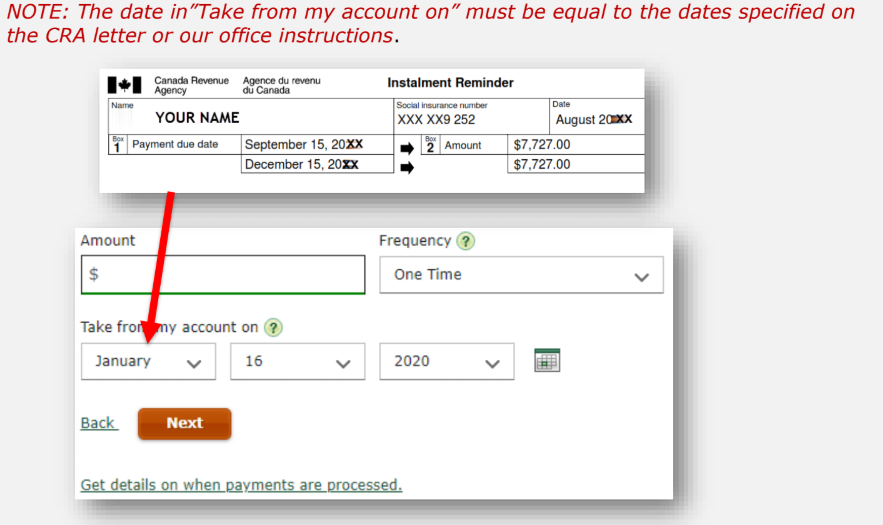

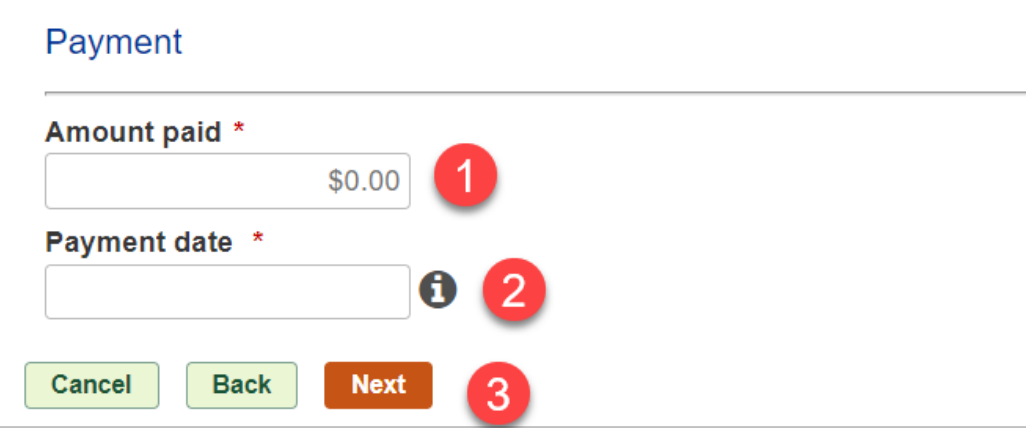

- Fill in the information below

- Click “Next”

Step 5:

Print payment confirmation as pdf and save

How to Pay Personal Tax in Amount Owing Using Online Banking

Step 1:

Sign into your TD banking service

- Click Pay Bills

- If CRA PIT - 202X is listed, select it and click “Pay Selected Payee.” And go directly to step 4 of this guide

- If not listed, click “Add Payee,” and follow Steps 2 and 3 of this guide

Step 2:

- Type “cra” in the Payee Name search bar

- Click “Search”

- Click “CRA PERSONAL INCOME TAX – AMOUNT OWING REMITTANCE VOUCHER

- Click “Add Selected Payee”

Step 3:

Enter your Social Insurance Number in the “Account Number” bar. You do not have to fill in “My Payee Name”

Step 4:

- Click “Finish”

- Fill in the information below

- Click “Next”

Print payment confirmation as pdf and save

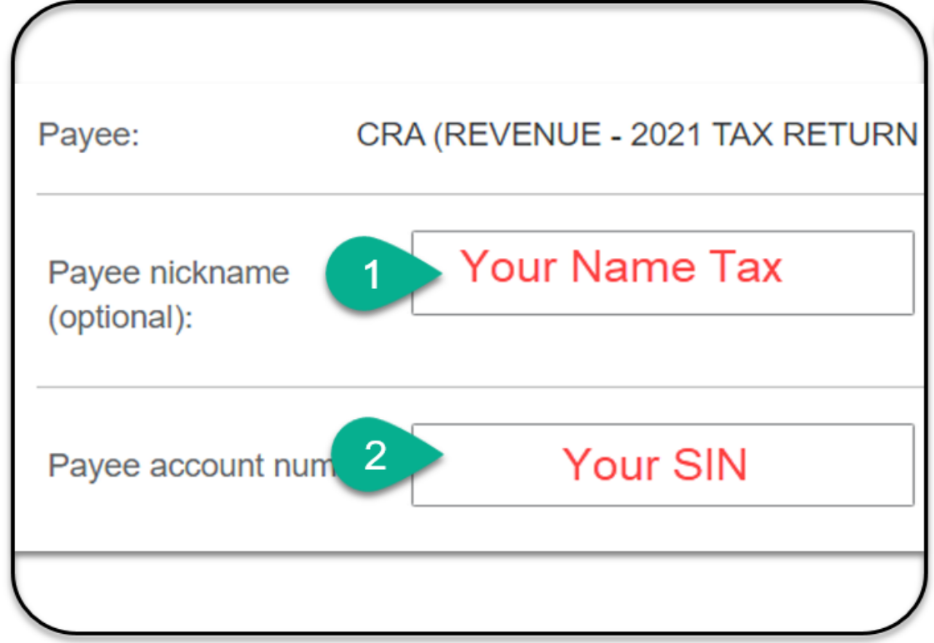

How to Pay Personal Tax Using Online Banking (CIBC)

Step 1:

Is “CRA (REVENUE - YYYY TAX RETURN” Listed as a Payee?

- If yes, click on that payee and skip to step 2 of this guide

- If no, follow step 1 below

- Click “Bill Payments”

- Select “Add or Edit Payees”

- Enter “CRA” in the search bar

- Click “Search”

- Select “CRA (REVENUE – YYYY TAX RETURN” and then select “Continue”

Step 2:

- Add a Payee nickname (usually your personal name + “tax”. For example, “John Smith tax”)

- Enter your nine digit Social Insurance Number in the “Payee Account Number” field.

- Click “Next,” then “Add Payee”

- Confirm the information is correct and select “Pay this bill”

- Enter the amount you wish to pay and the account you would like to pay from and click ”Next”

- Click “Set up Payments”

Step 3:

Print the confirmation screen for your records

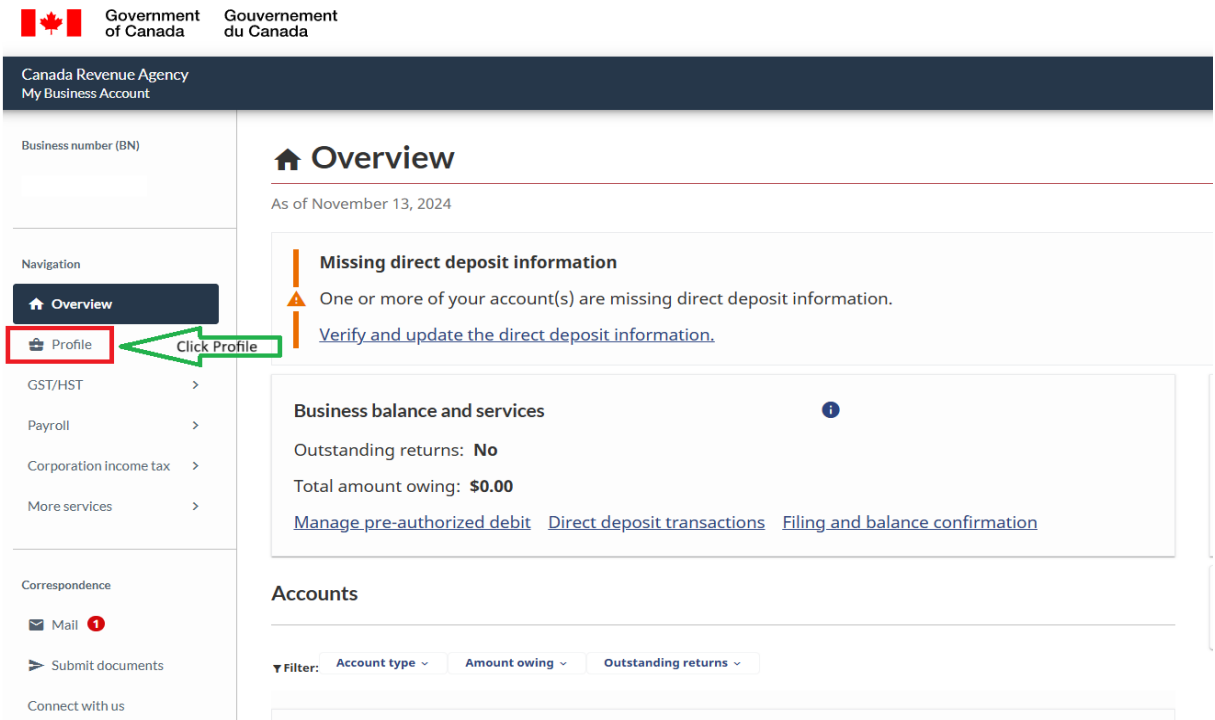

How to Authorize a Representative for Your Business

Note: This process cannot be done using mobile

Step 1:

Sign into your CRA business account using this link:

https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/business-account.html

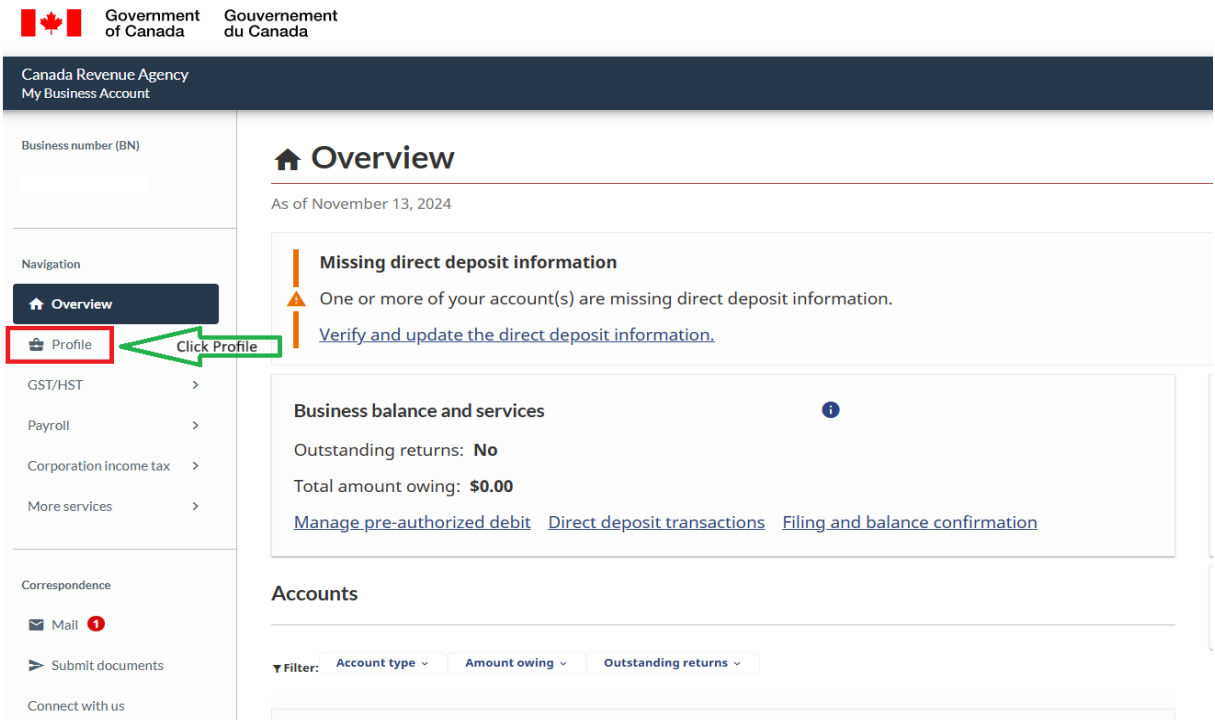

Step 2:

After logging in to your account, click on “Profile”

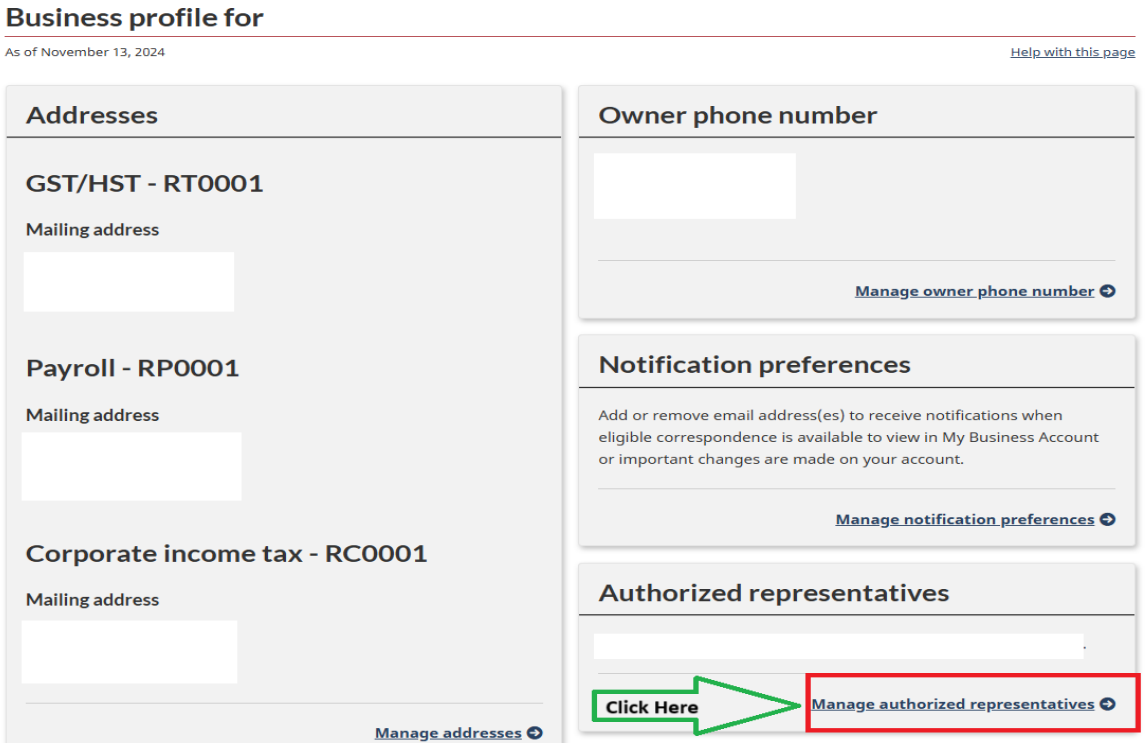

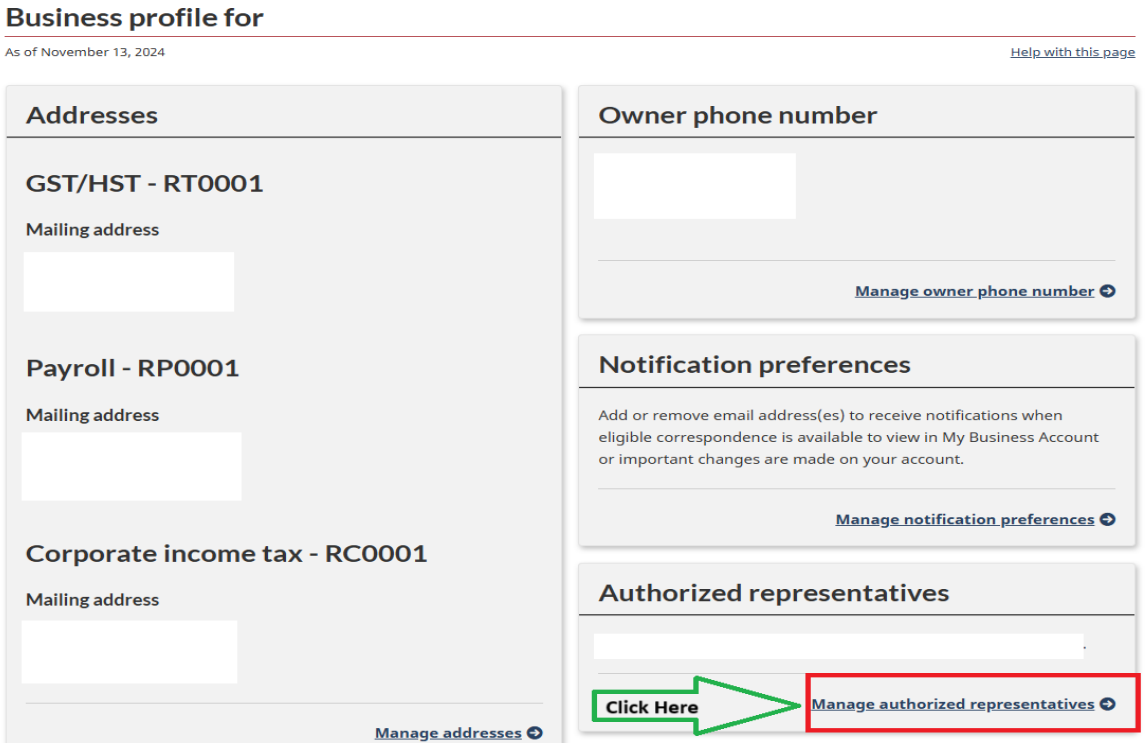

Step 3:

Click on “Manage authorized representatives”

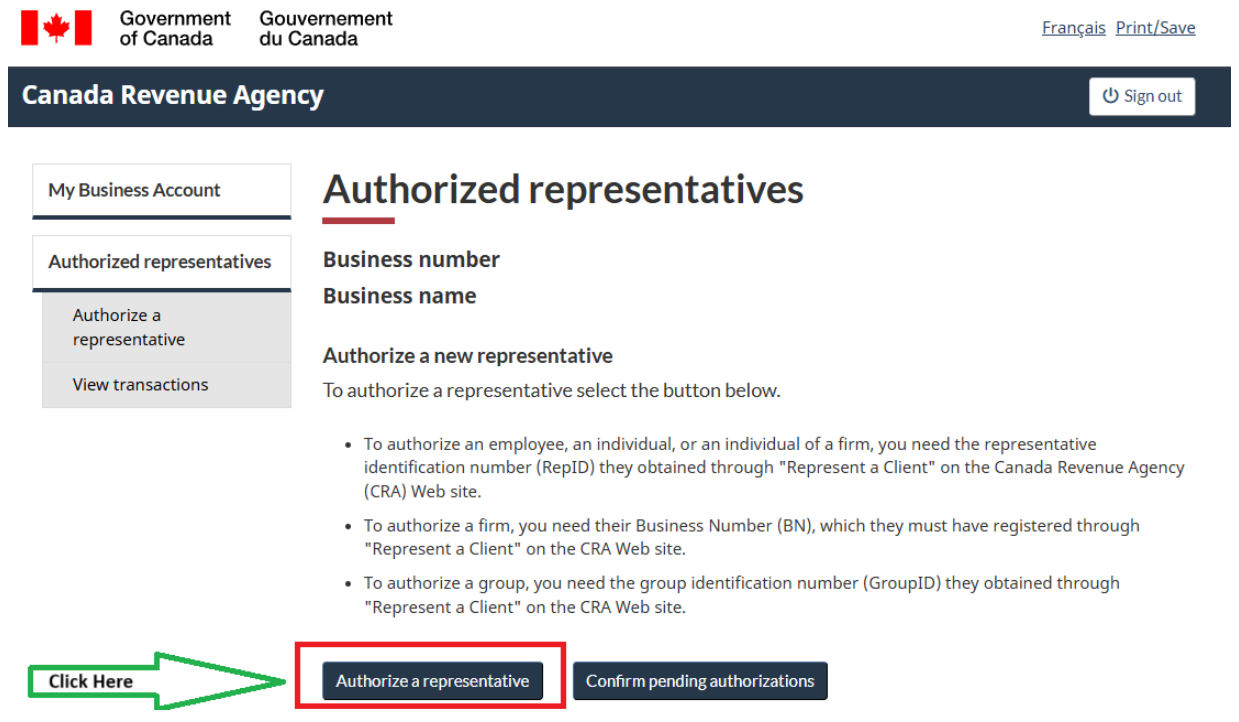

Step 4:

Click on “Authorize a representative”

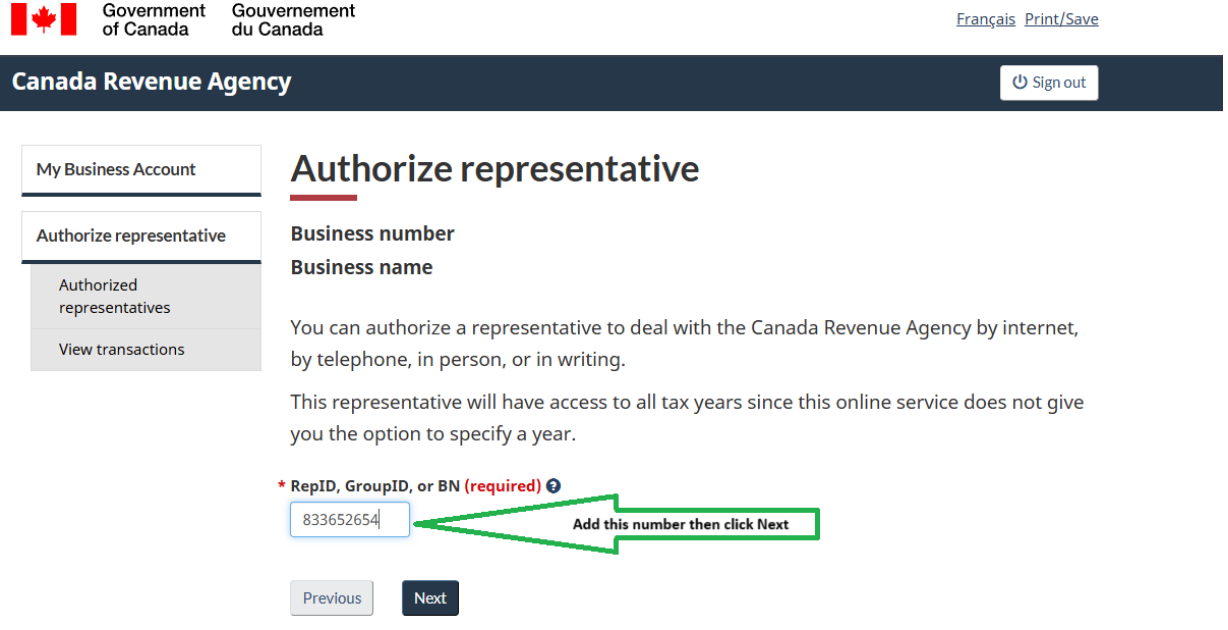

Step 5:

Type “833652654” in the blank box then click Next

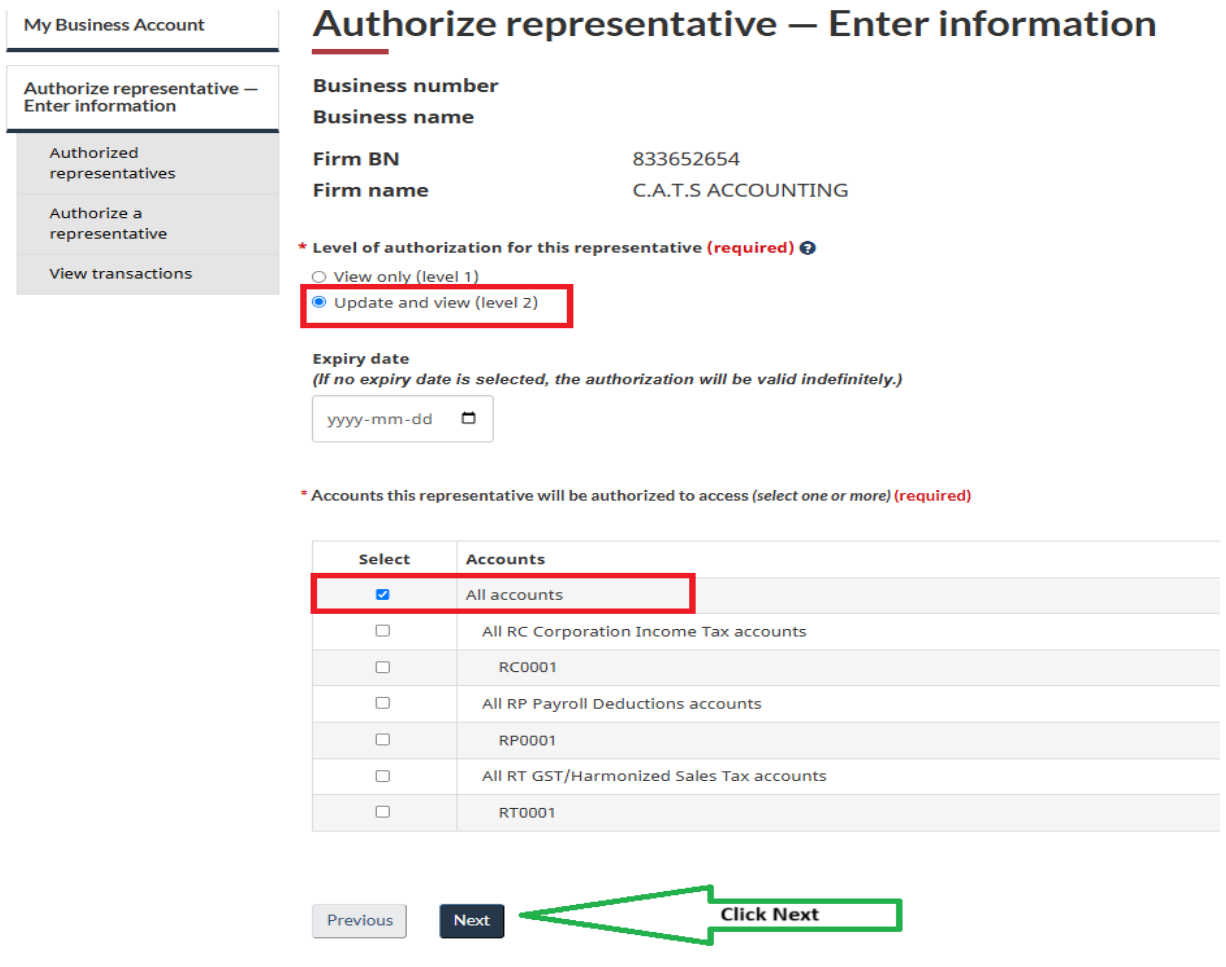

Step 6:

Click on “Update and view (level 2)” and select “All accounts” then click Next

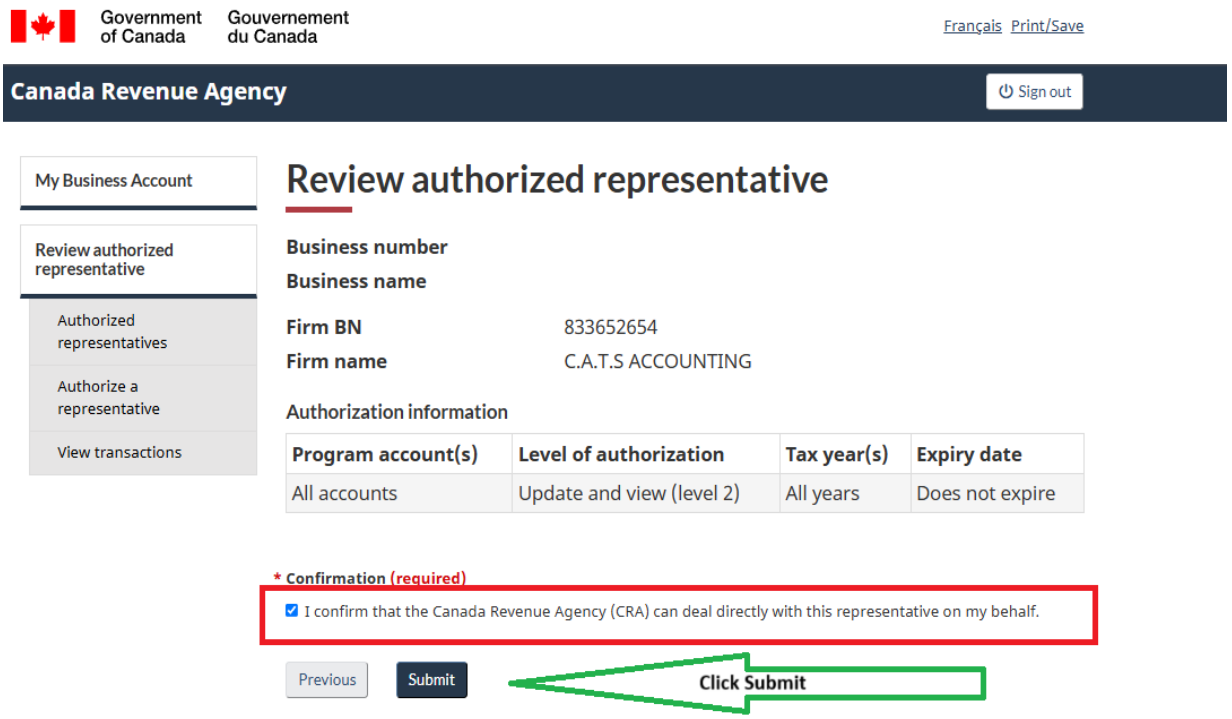

Step 7:

Click on “I confirm that the Canada Revenue Agency (CRA) can deal directly with this representative on my behalf.” Then click Submit.

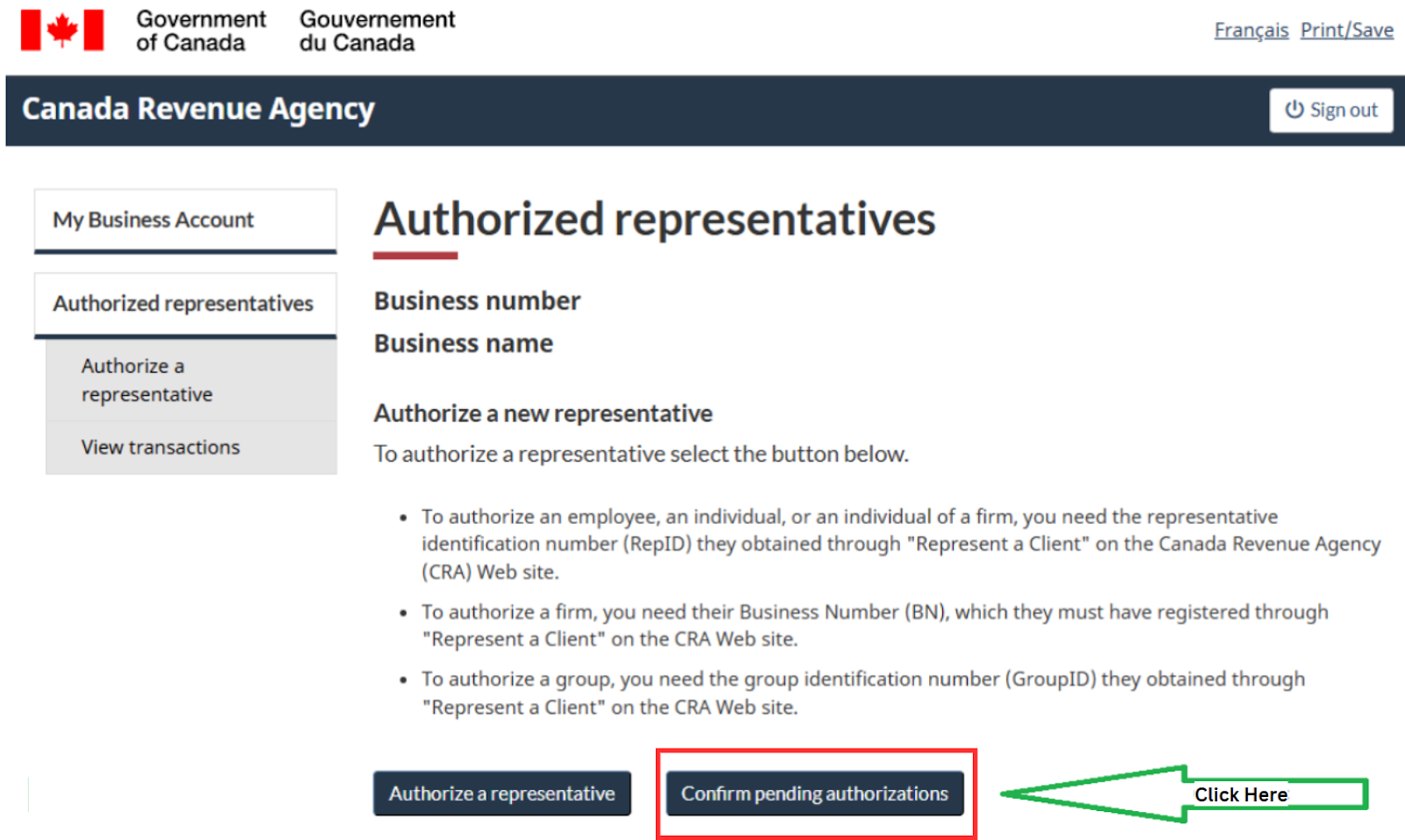

How to Confirm Pending Authorization Using the CRA’s “My Business” Account

Step 1:

- Sign in to your business account using this link: https://www.canada.ca/en/revenue-agency/services/e-services/digital-services-businesses/business-account.html

- Click “Profile”

Step 2:

Scroll down to the “Authorized Representative” area and click the “Manage Authorized Representatives” link

Step 3:

Click “Confirm Pending Authorization” to confirm our representation

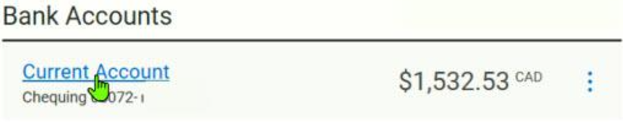

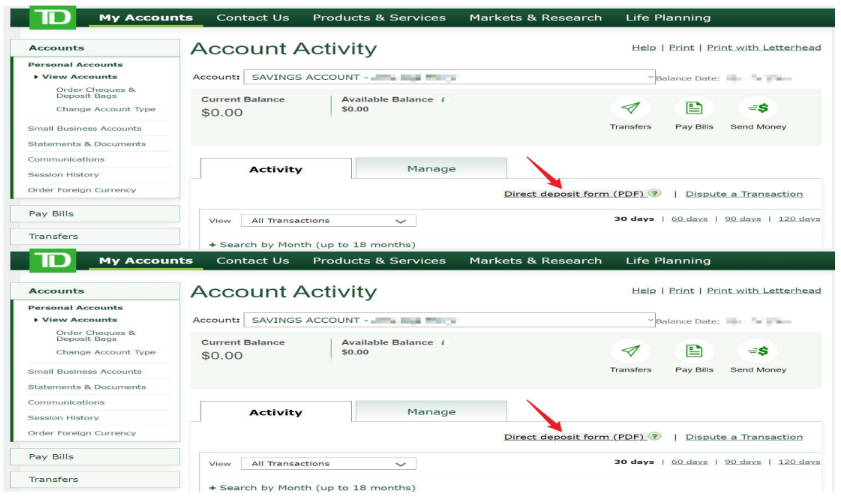

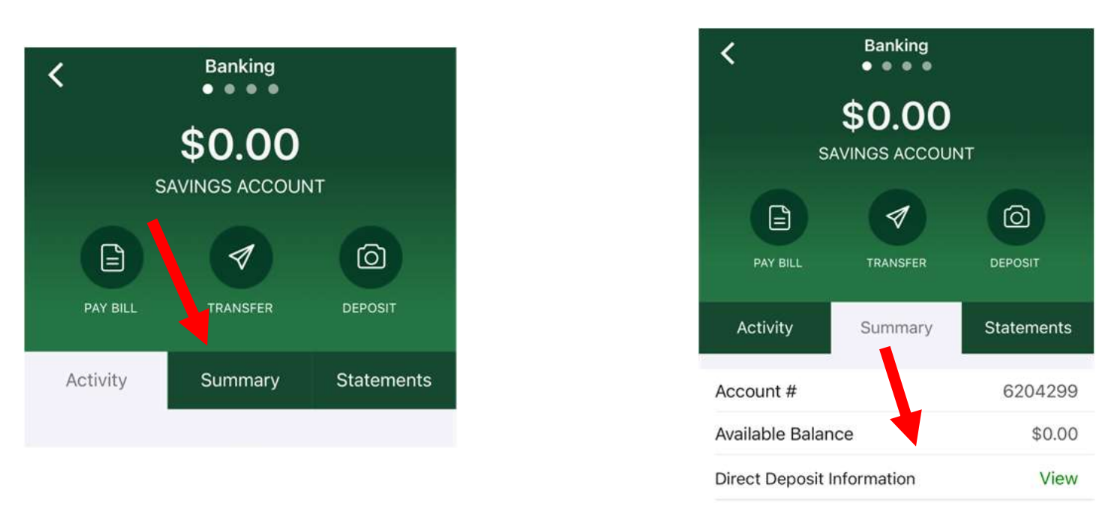

How to Get Direct Deposit Information From TD Bank

Online:

Login to your TD account and click “Direct Deposit PDF”

Mobile App:

Click “Summary” and then click “View Direct Deposit Information”

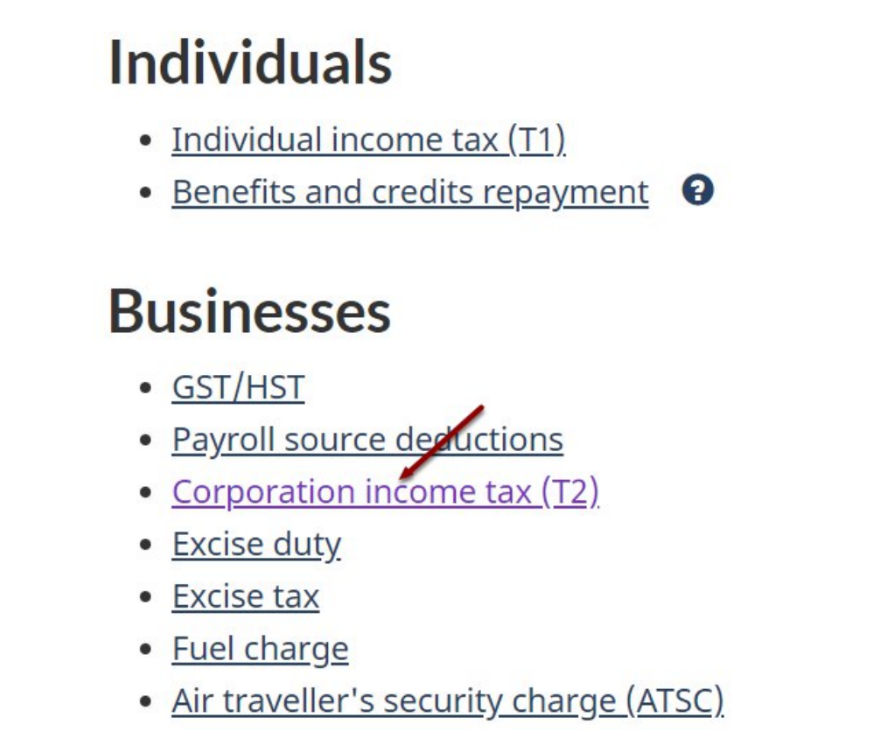

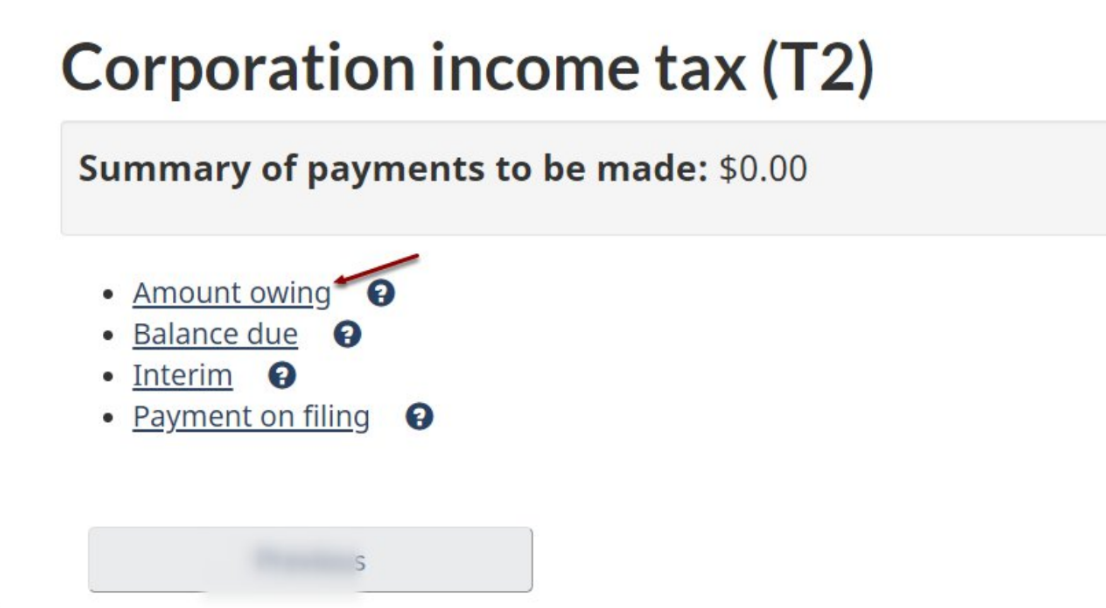

How to Pay Personal Tax Amount Owing Balance Due

Step 1:

Click on the following link: https://apps.cra-arc.gc.ca/ebci/fppp/mypymnt/pub/ntr.action?request_locale=en_CA

Step 2:

Under the “Businesses” section, find “Corporate income tax (T2)” and click on it

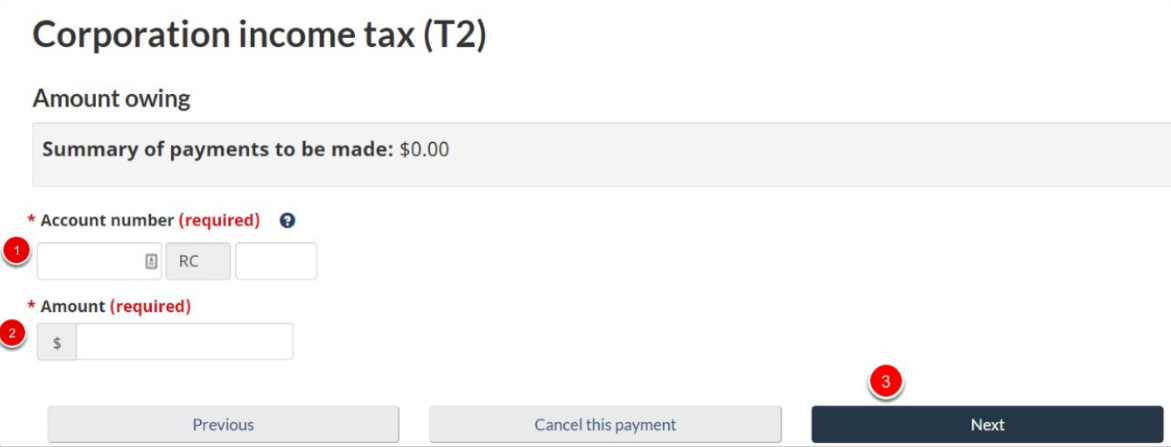

Step 3:

Click on “Amount owing”

Step 4:

Enter the Corporate Business Number, and the amount to be paid and click next, then “Confirm and Proceed to Pay”

Note that “Period Ending” is your corporate Year-end you are making the payment for

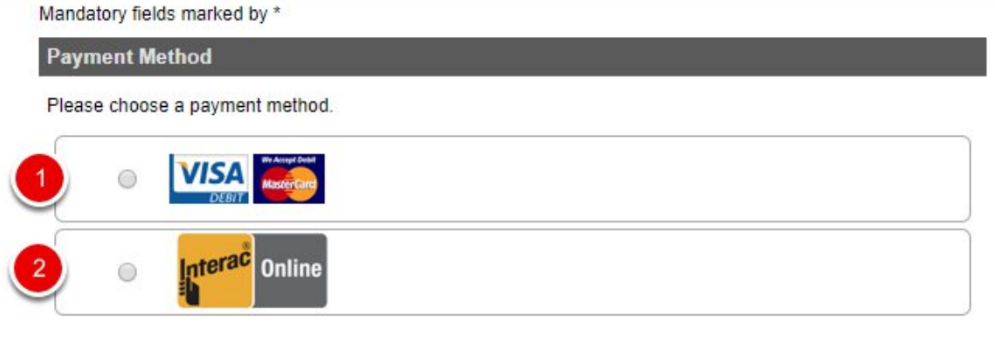

Step 5:

Choose a payment method. You can pay using credit cards (Subject to 2.5% fees) or “Interac” online banking (Must be a Business Account)

Note that personal accounts are not accepted when making this payment

Step 6:

After completing the payment, print the payment confirmation page for your personal records

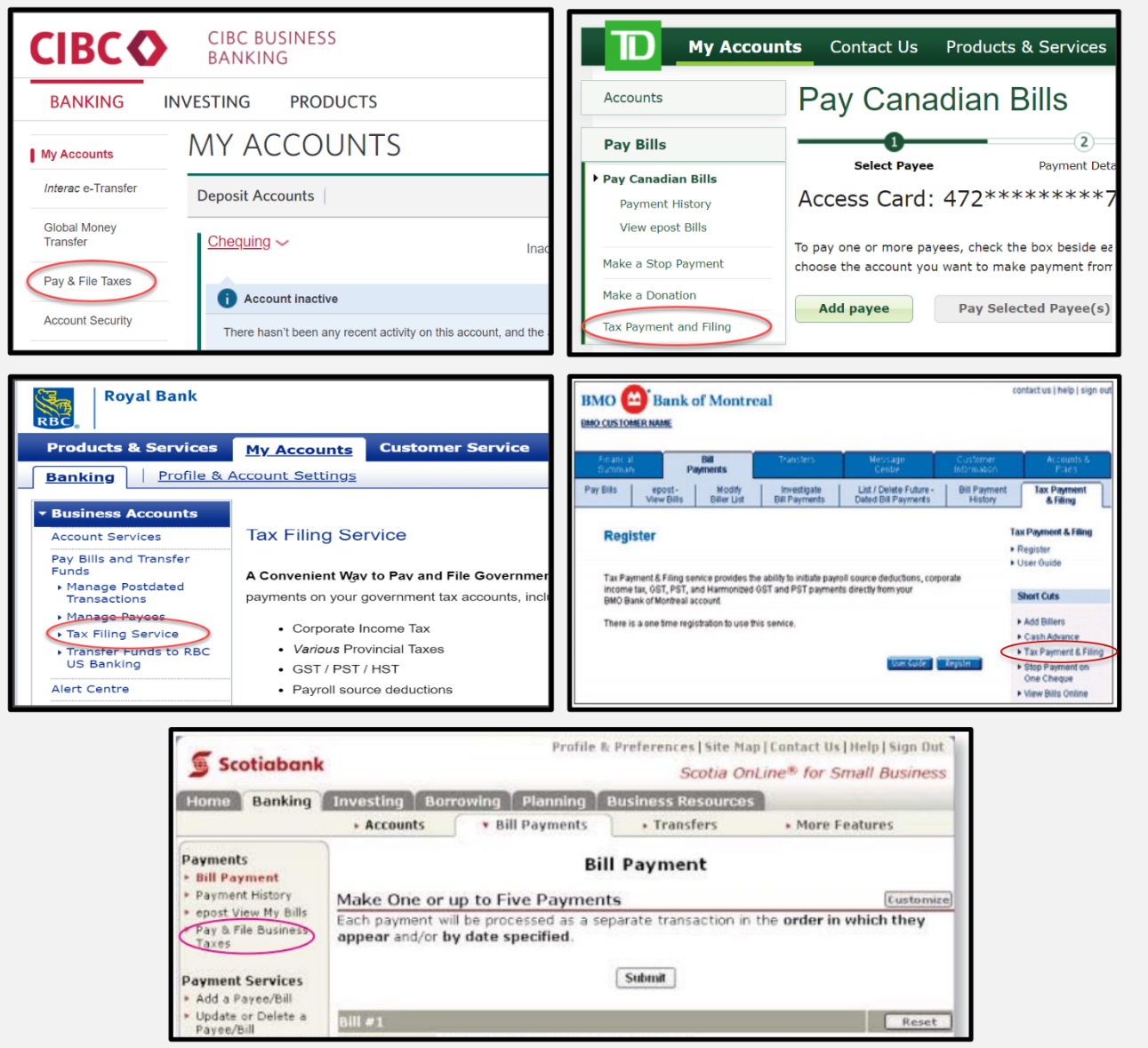

How to Remit (Pay) Corporate Tax Using Online Banking (Payment on Filing)

Note: This process cannot be done using mobile banking or personal bank accounts

Step 1:

Sign into your financial institution’s online banking for business

Step 2:

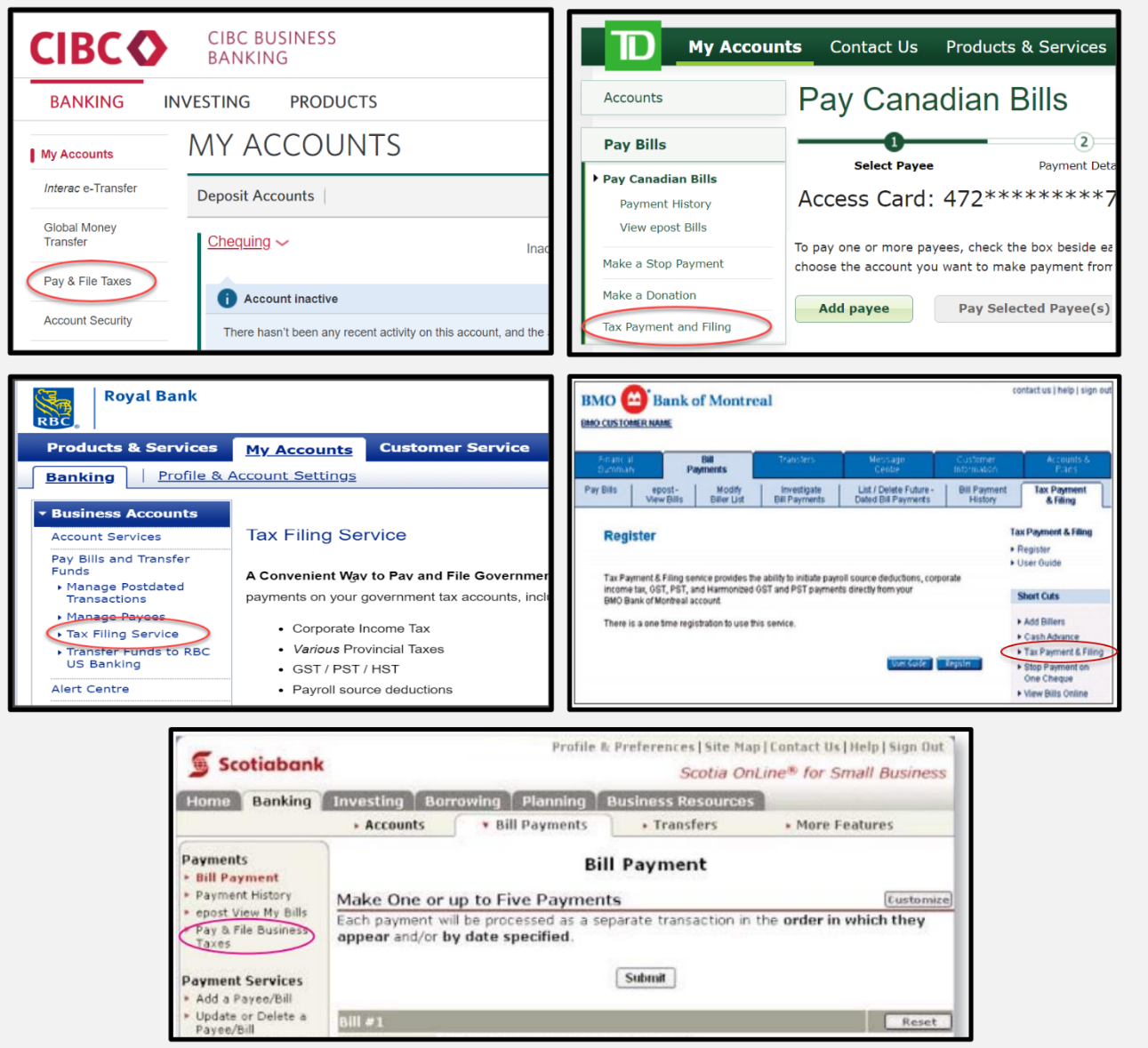

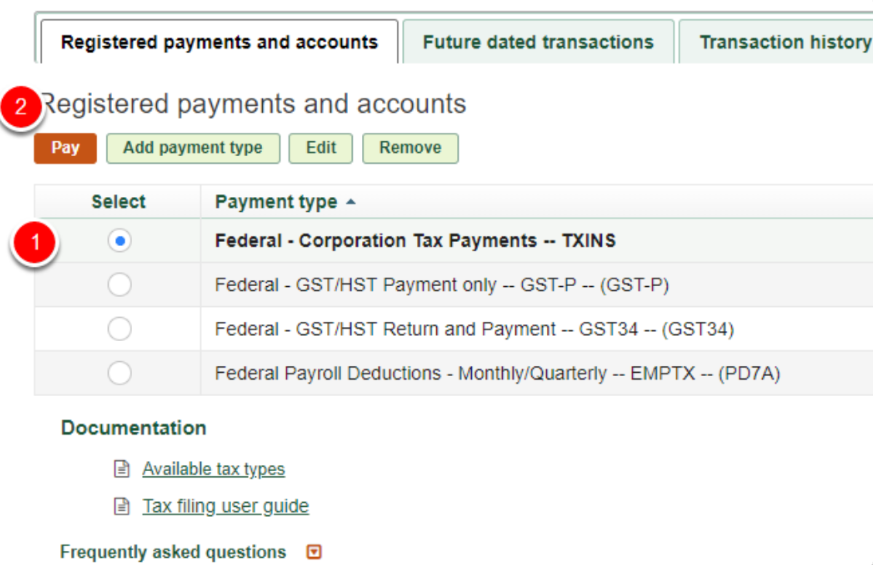

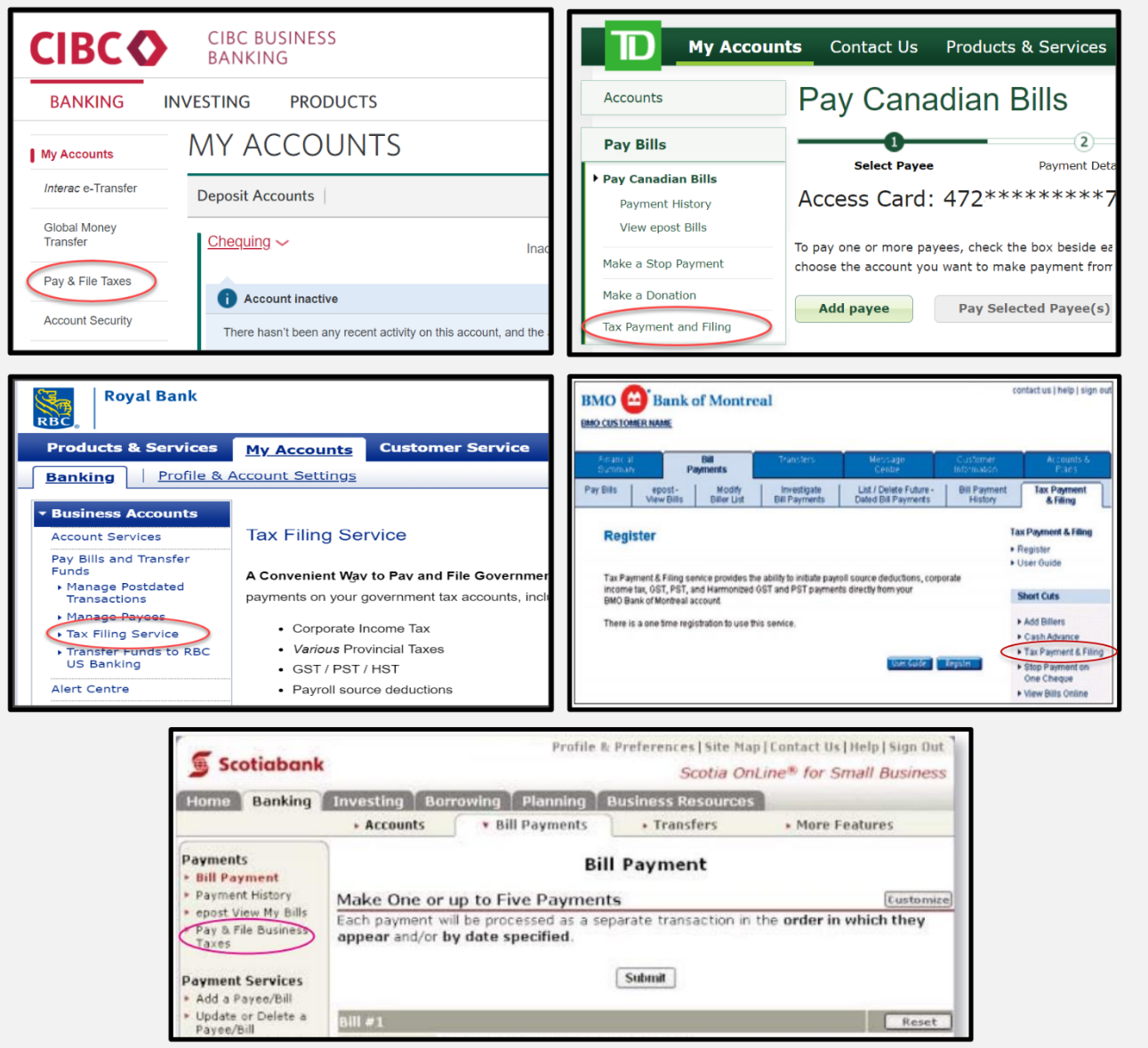

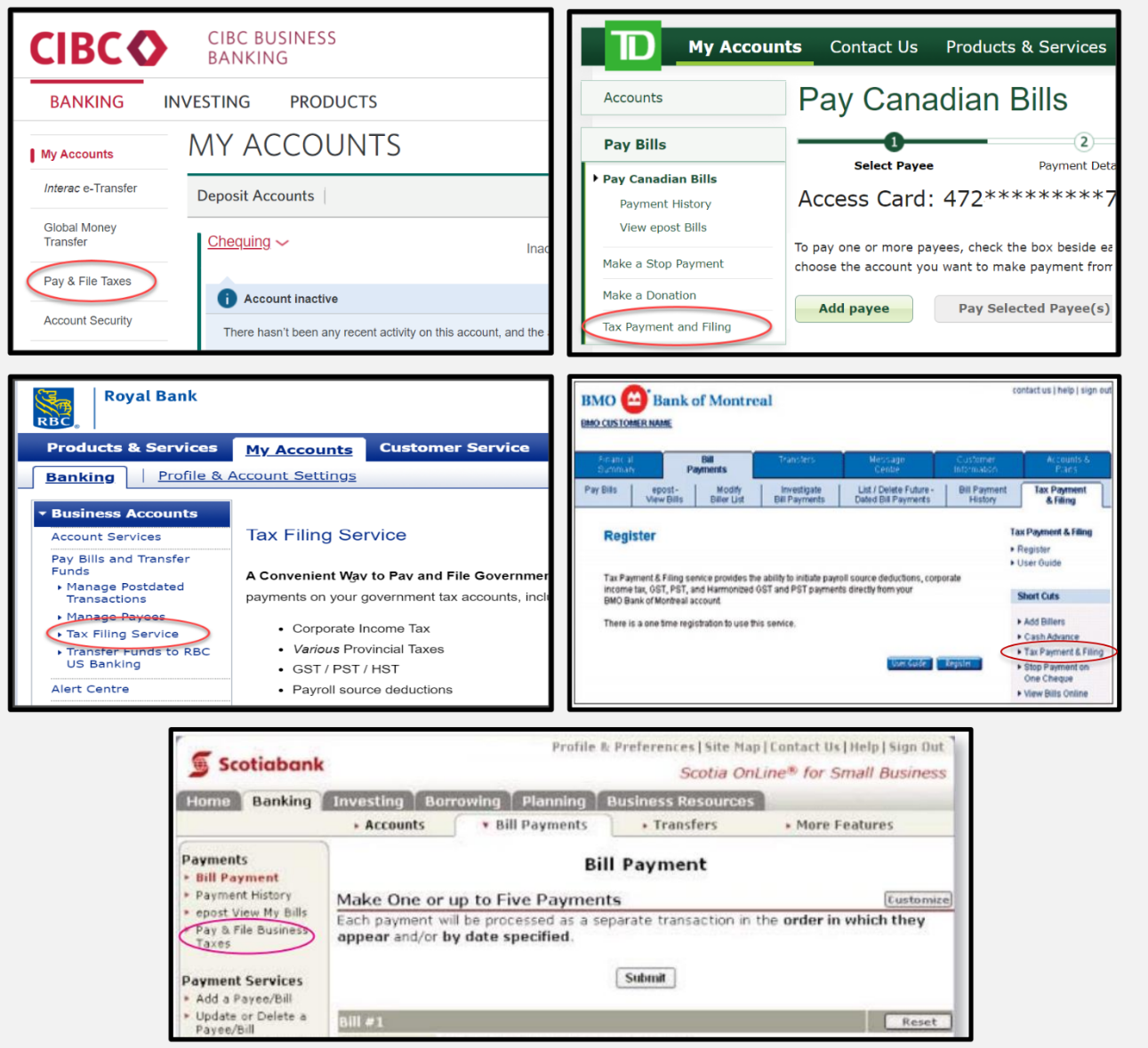

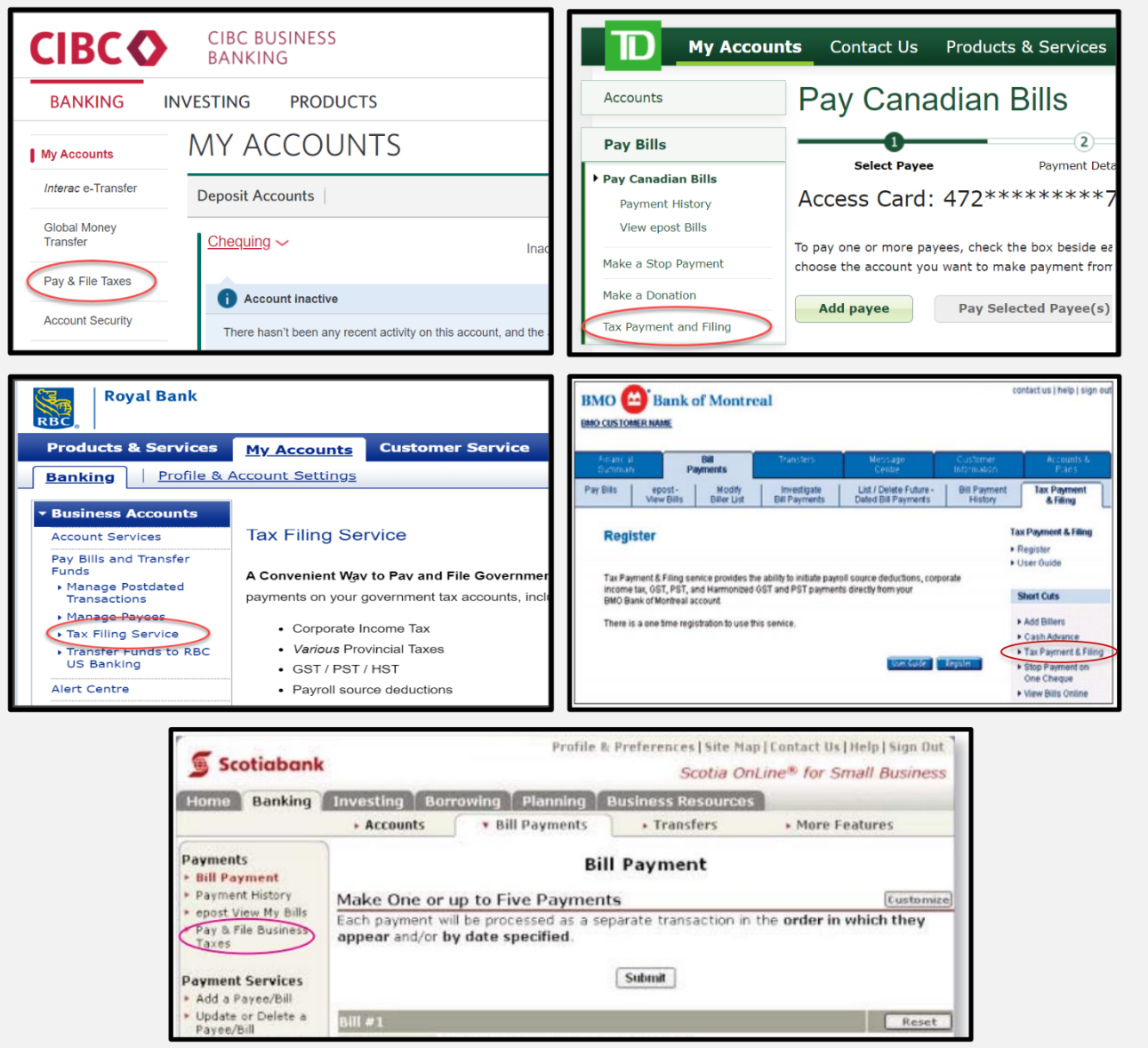

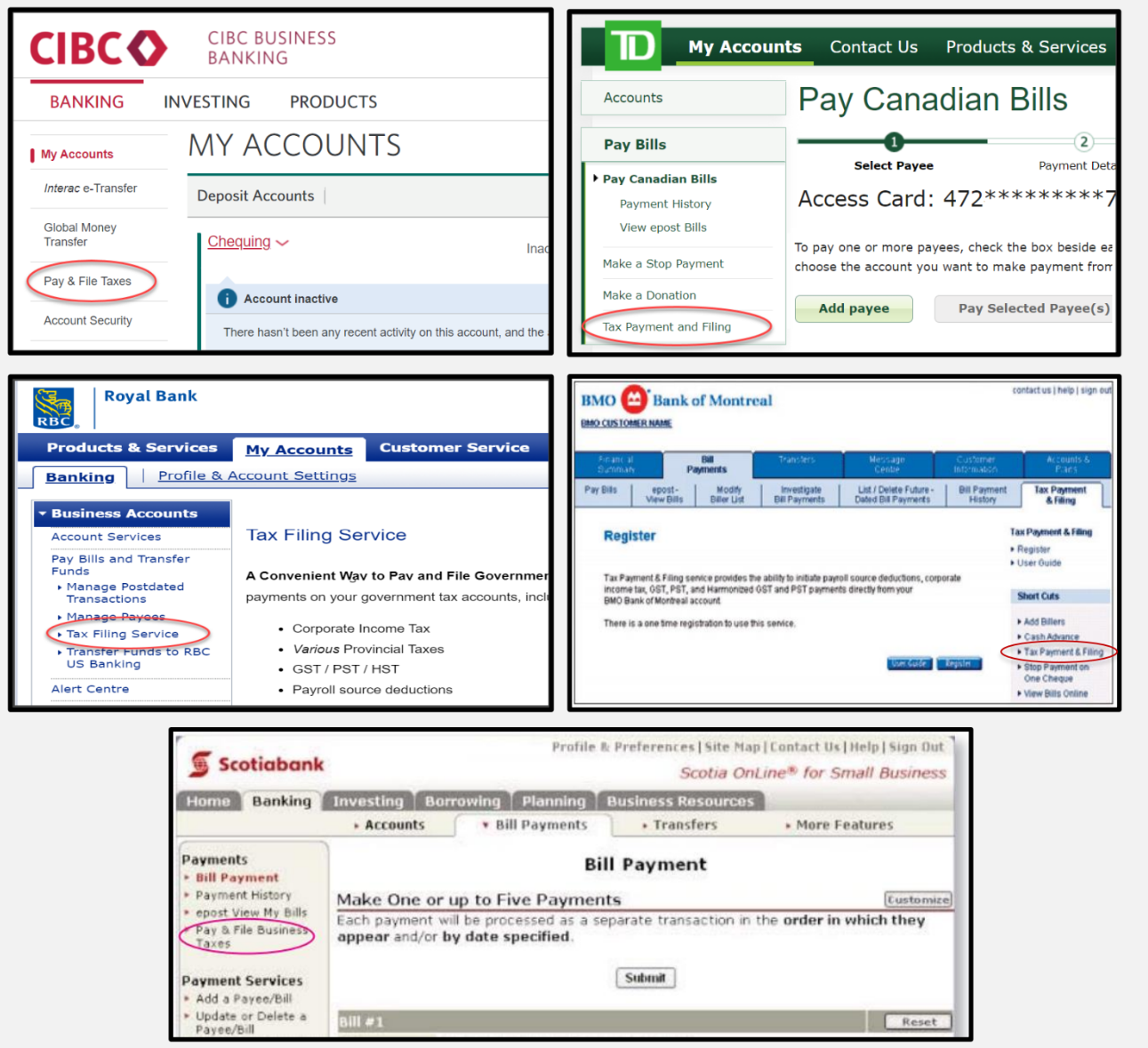

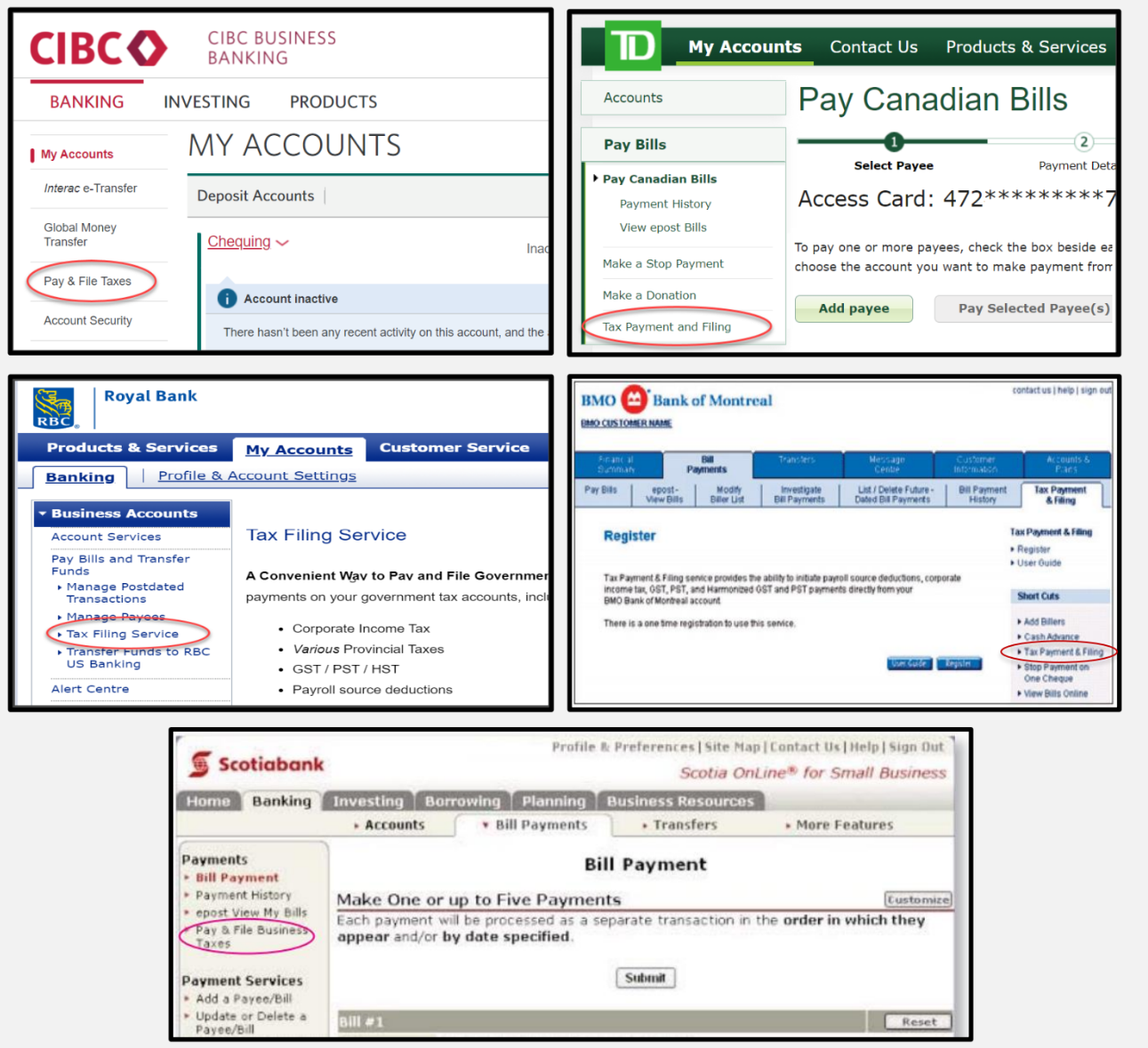

Find the Tax Payment section according to your bank as indicated below.

Step 3:

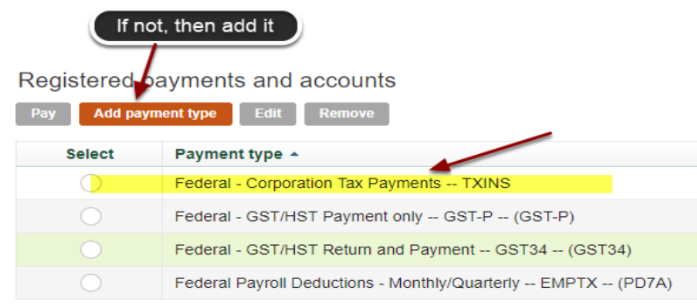

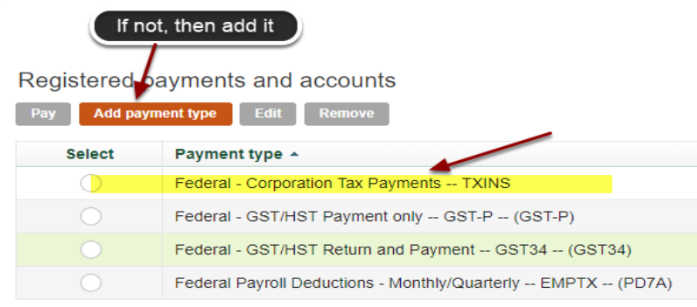

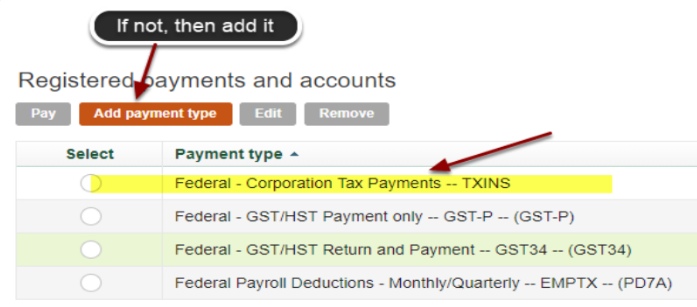

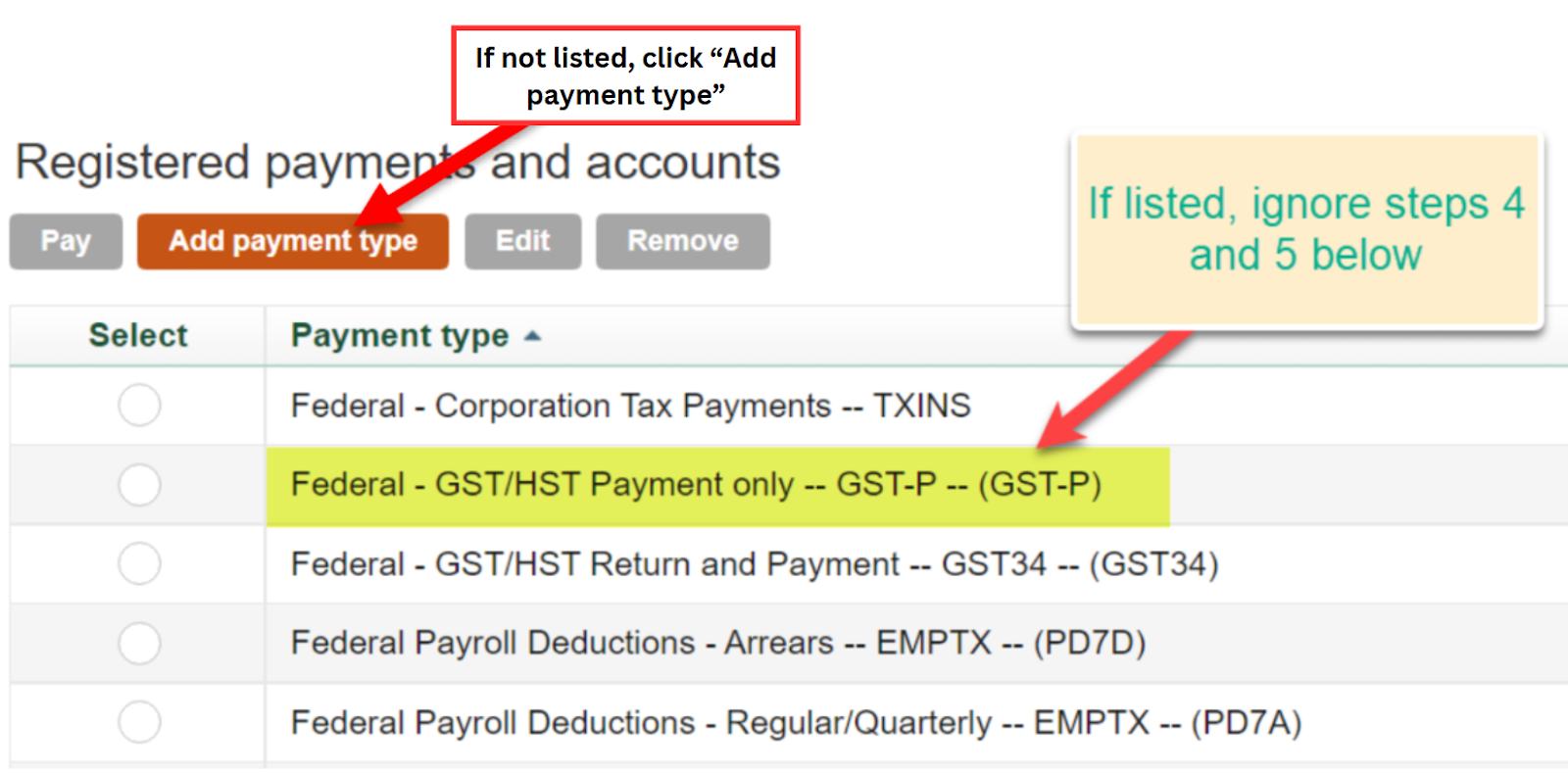

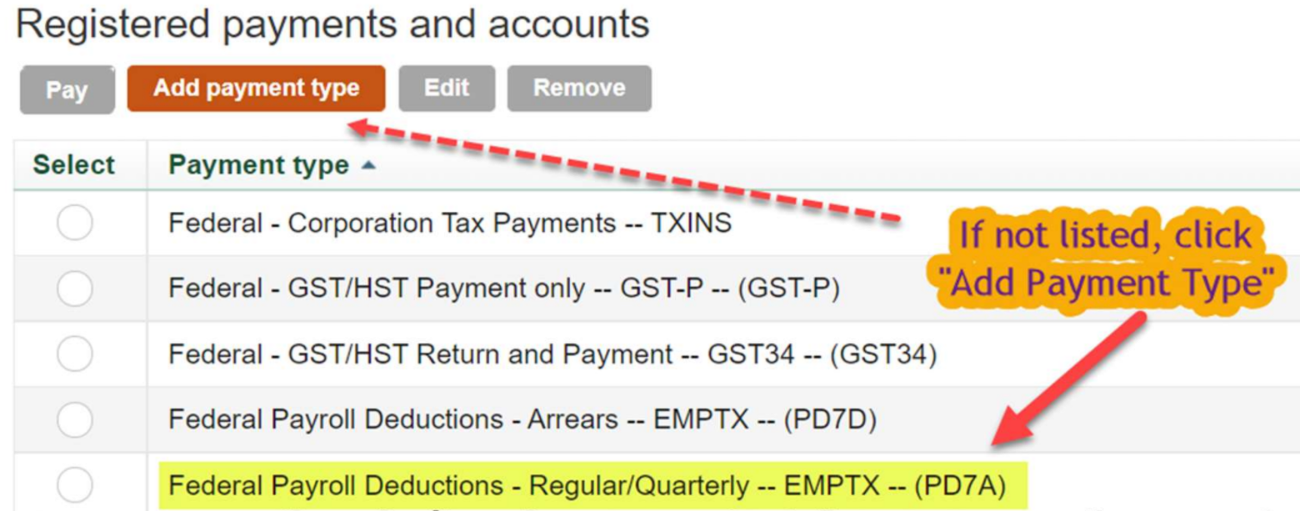

Add “Federal – Corporation Tax Payment – TXINS” if needed

Is “Federal – Corporation Tax Payment – TXINS” listed?

- Yes: Skip to step 6 of this guide

- No: Follow steps 3-5 of this guide, then proceed with step 6

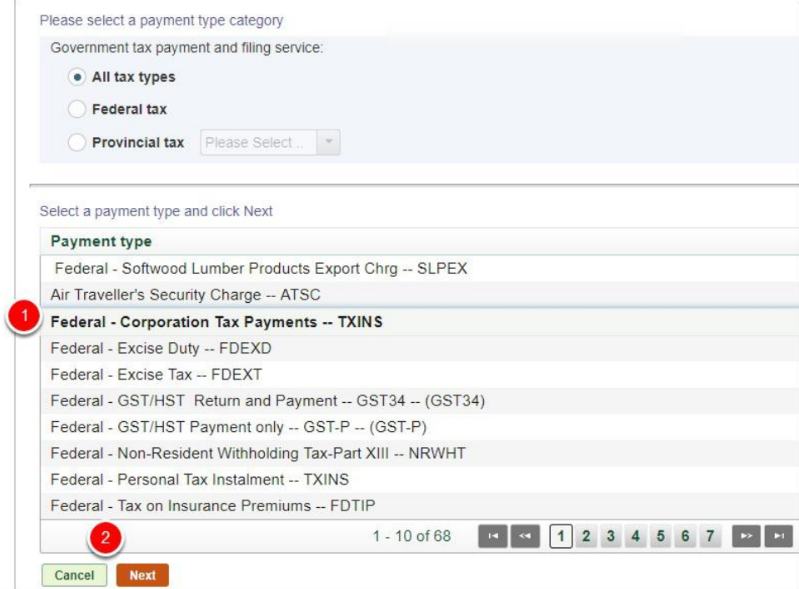

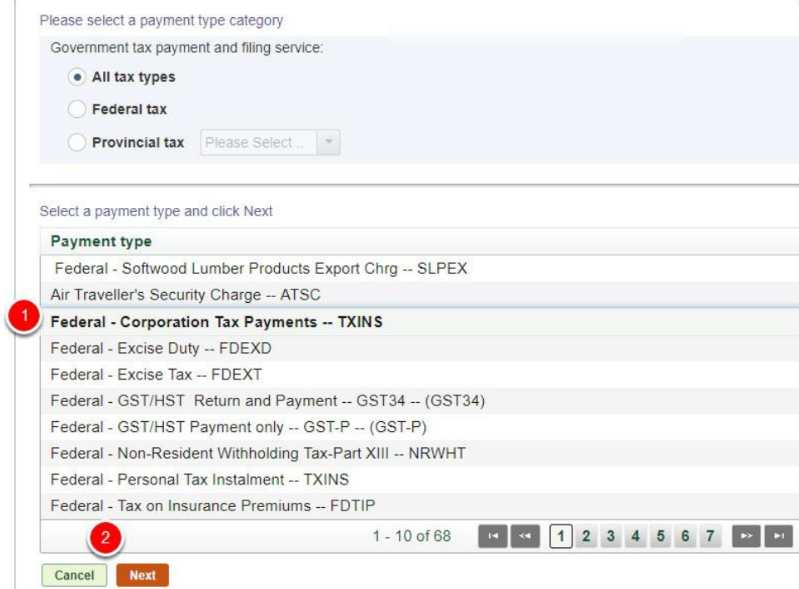

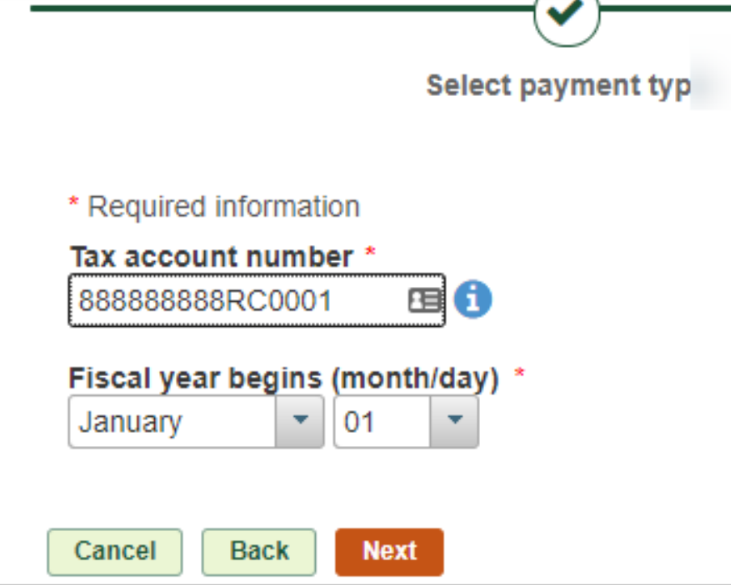

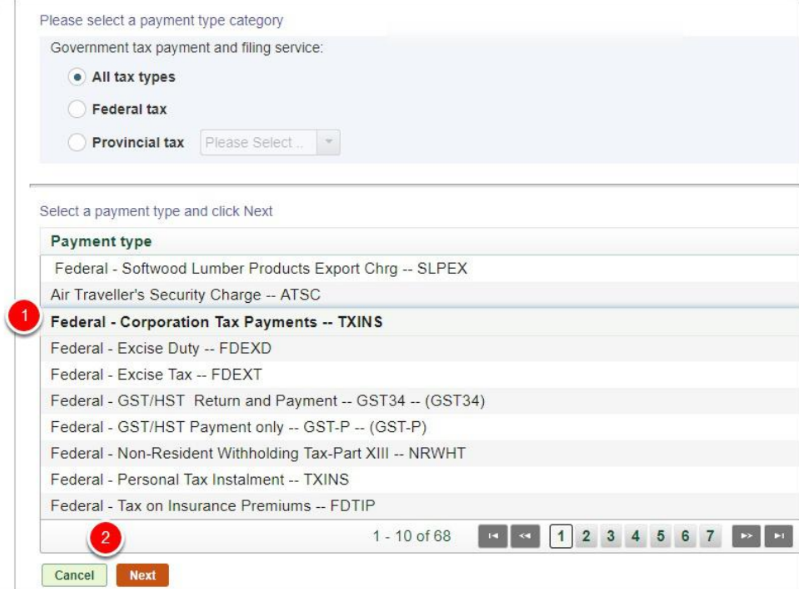

Step 4:

Select “Federal – Corporation Tax Payment – TXINS,” then click “Next”

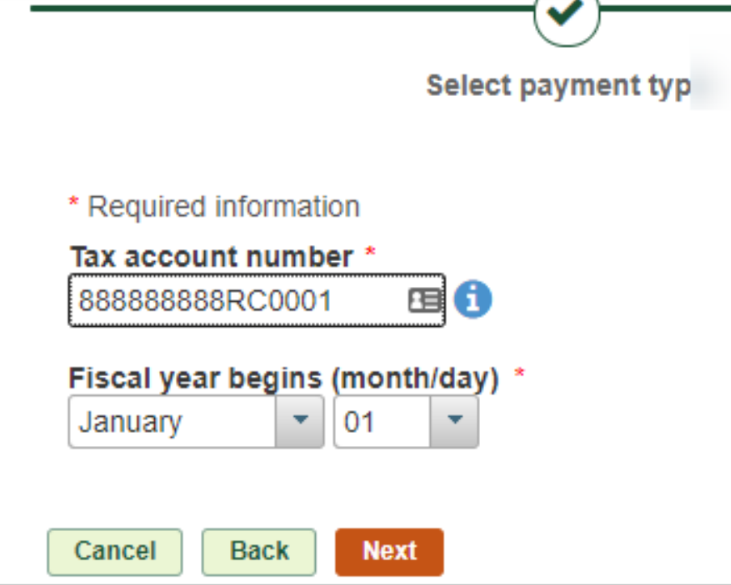

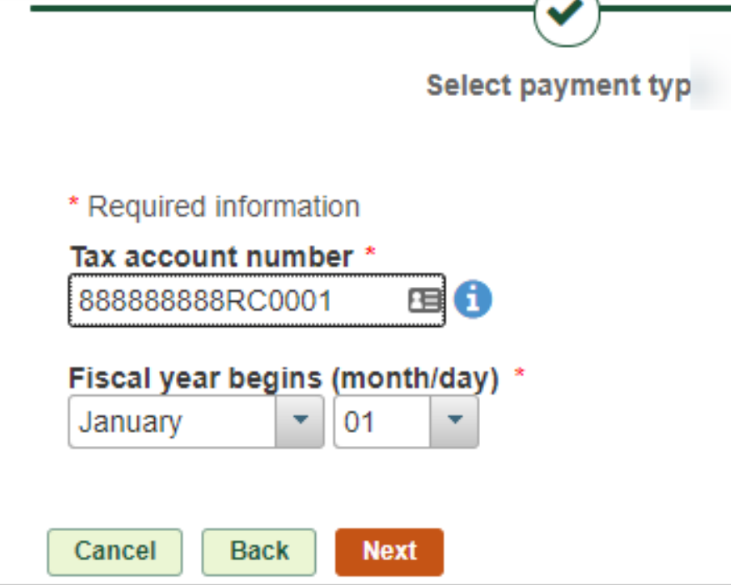

Step 5:

Enter your corporate Business Number (RC number) – it contains 9 digits + RC + 0001, and the Fiscal year beginning date, then click next

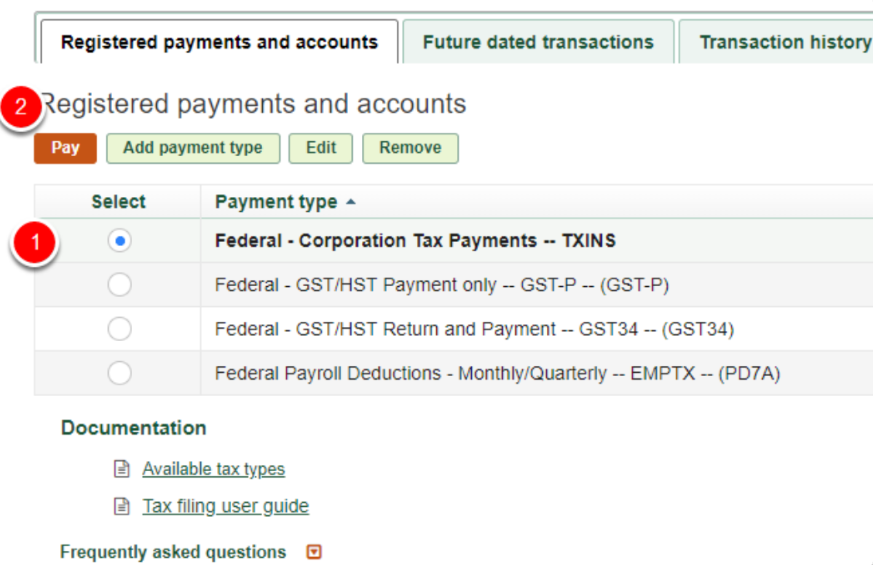

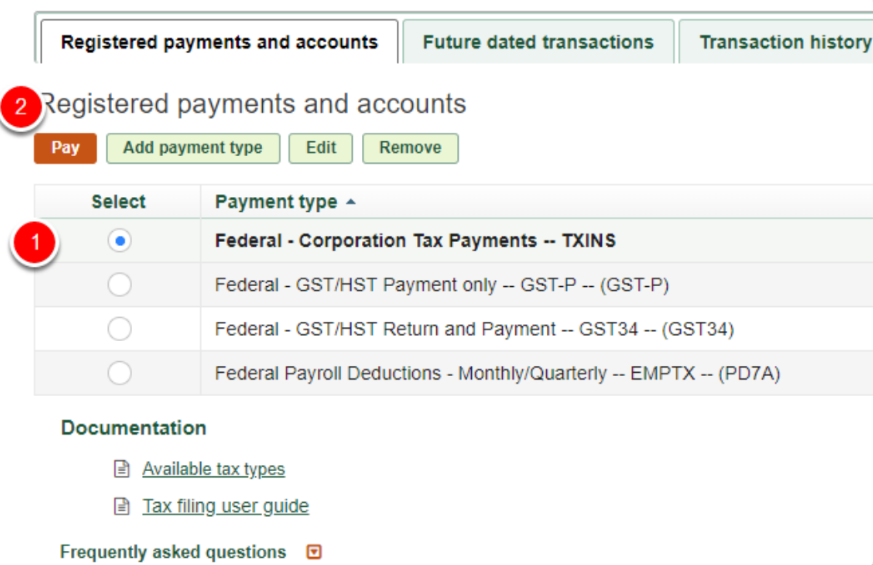

Step 6:

Once added, select it and click “Pay”

Step 7:

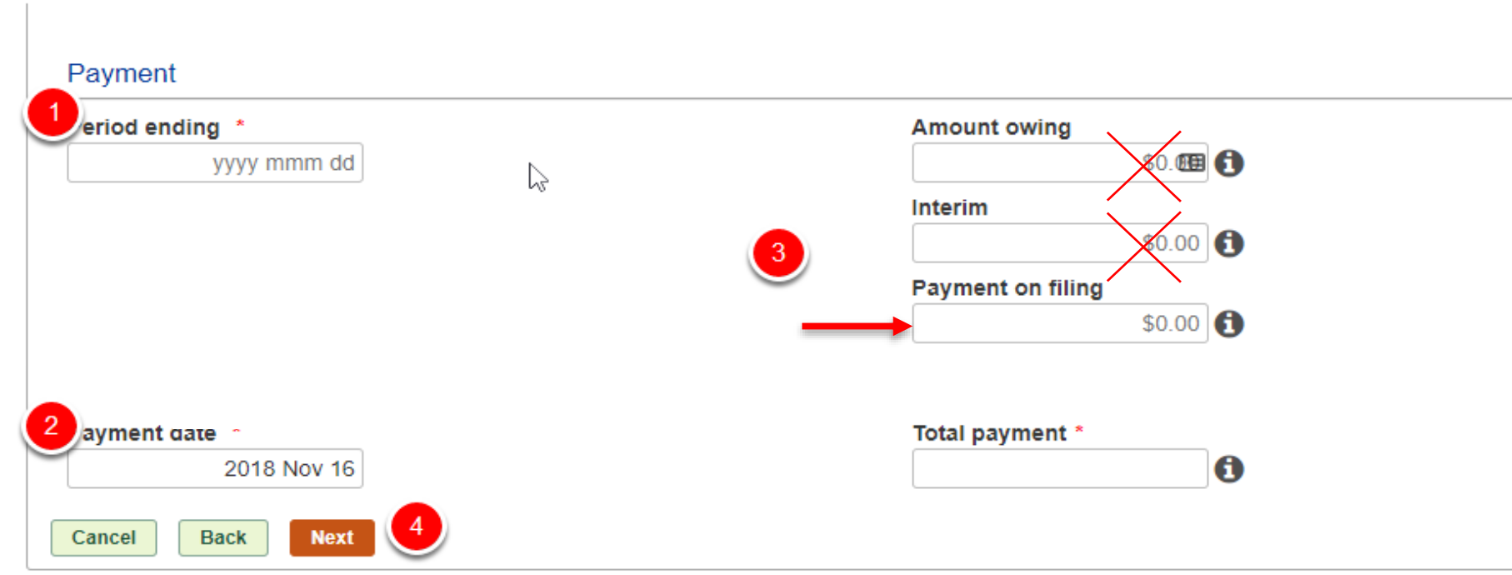

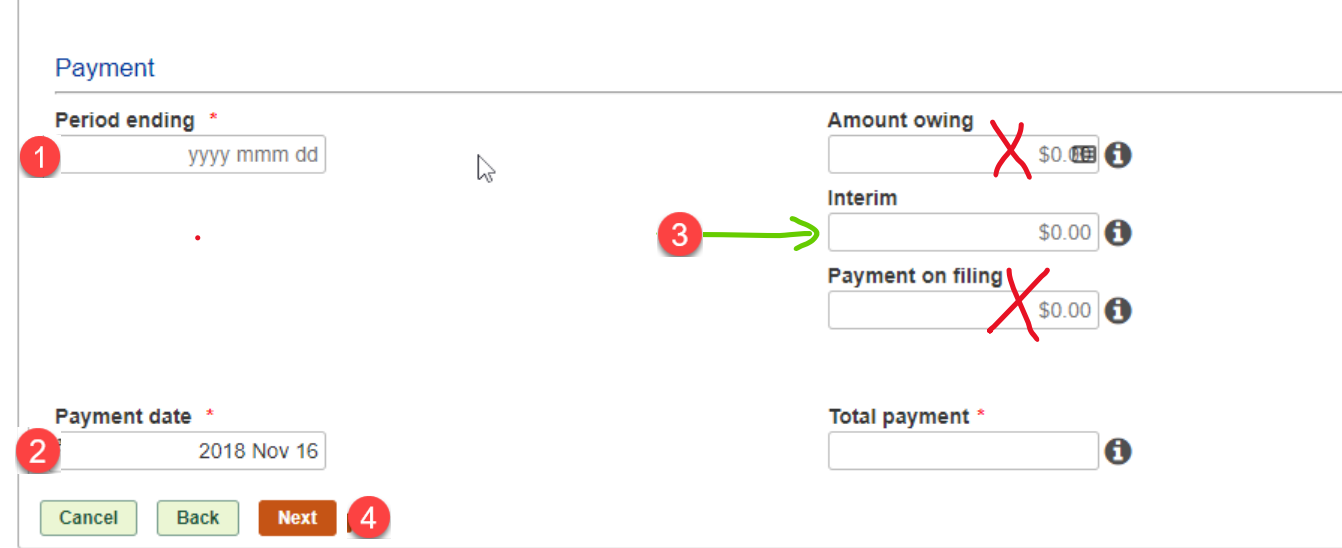

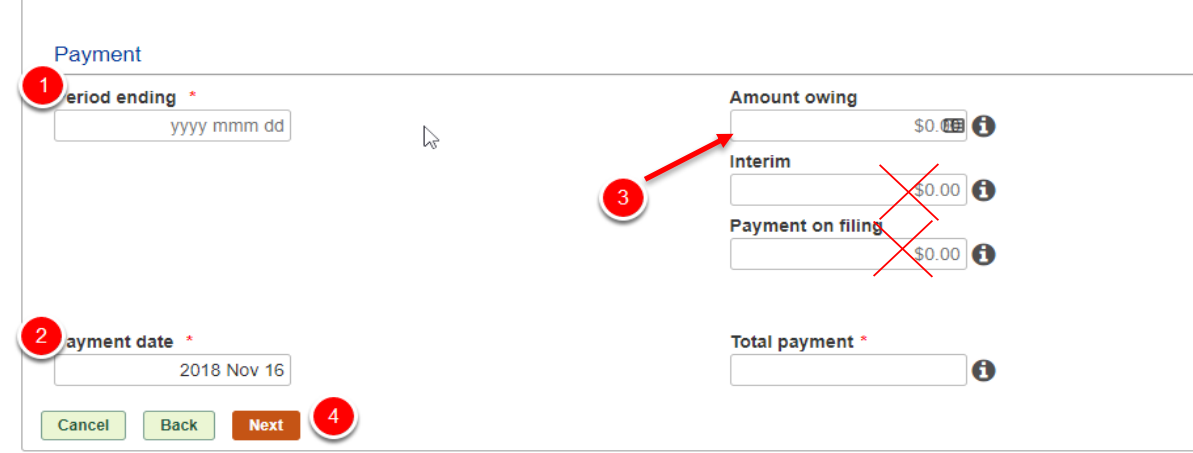

Fill out the payment form as follows:

- Period ending: is your corporate year to which you are making this payment (Example: 20XX-12-31)

- Payment Date: This is the date you specify for the bank to process this payment.

- Enter the amount due in “Payment On Filing.” Don’t use “Interim” or “Amount owing”

- Click Next – Review the information, then click Submit

Step 8:

Print the confirmation sheet in PDF format and email it to us

How to Remit (Pay) Corporate Tax Using Online Banking (Interim)

Note: This process cannot be done using mobile banking or personal bank accounts

Step 1:

Sign into your financial institution’s online banking for business

Step 2:

Find the Tax Payment section according to your bank as indicated below.

Step 3:

Add “Federal – Corporation Tax Payment – TXINS” if needed

Is “Federal – Corporation Tax Payment – TXINS” listed?

- Yes: Skip to step 6 of this guide

- No: Follow steps 3-5 of this guide, then proceed with step 6

Step 4:

Select “Federal – Corporation Tax Payment – TXINS,” then click “Next”

Step 5:

Enter your corporate Business Number (RC number) – it contains 9 digits + RC + 0001, and the Fiscal year beginning date, then click next

Step 6:

Once added, select it and click “Pay”

Step 7:

Fill out the payment form as follows:

- Period ending: is your corporate year to which you are making this payment (Example: 20XX-12-31)

- Payment Date: This is the date you specify for the bank to process this payment.

- Enter the amount due in “Interim” Don’t use “Payment on filing” or “Amount owing”

- Click Next – Review the information, then click Submit

Step 8:

Print the confirmation sheet in PDF format and email it to us

How to Remit (Pay) Corporate Tax Using Online Banking (Amount Owing)

Note: This process cannot be done using mobile banking or personal bank accounts

Step 1:

Sign into your financial institution’s online banking for business

Step 2:

Find the Tax Payment section according to your bank as indicated below.

Step 3:

Add “Federal – Corporation Tax Payment – TXINS” if needed

Is “Federal – Corporation Tax Payment – TXINS” listed?

- Yes: Skip to step 6 of this guide

- No: Follow steps 3-5 of this guide, then proceed with step 6

Step 4:

Select “Federal – Corporation Tax Payment – TXINS,” then click “Next”

Step 5:

Enter your corporate Business Number (RC number) – it contains 9 digits + RC + 0001, and the Fiscal year beginning date, then click next

Step 6:

Once added, select it and click “Pay”

Step 7:

Fill out the payment form as follows:

- Period ending: is your corporate year to which you are making this payment (Example: 20XX-12-31)

- Payment Date: This is the date you specify for the bank to process this payment.

- Enter the amount due in “Amount owing” Don’t use “Payment on filing” or “Interim”

- Click Next – Review the information, then click Submit

Step 8:

Print the confirmation sheet in PDF format and email it to us

How to Pay (GST/HST) Using Online Banking

Note: This process cannot be done using mobile banking or personal bank accounts

Step 1:

Sign into your financial institution’s online banking for business

Step 2:

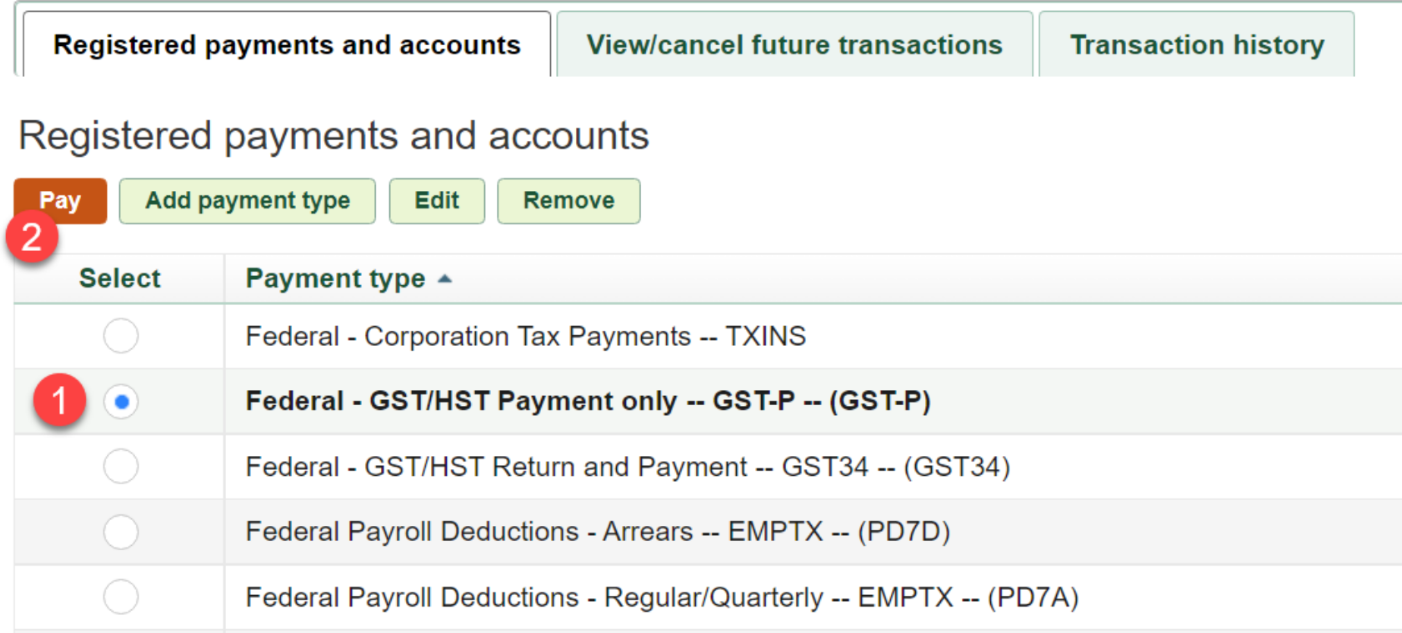

Find the Tax Payment section according to your bank as indicated below.

Step 3:

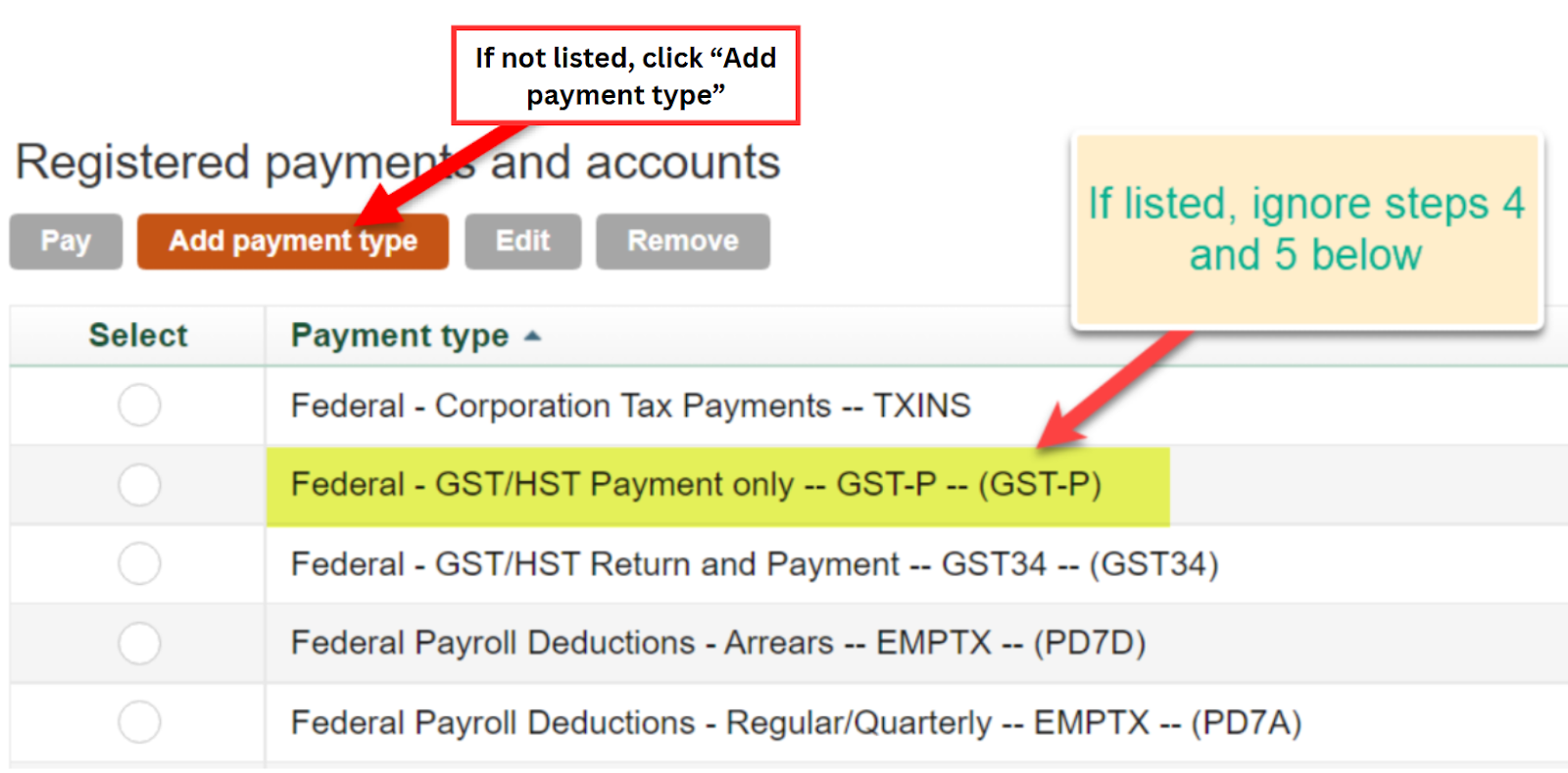

Add “Federal – GST/HST Payment only — GST-P — (GST-P)” if needed

Is “Federal – GST/HST Payment only — GST-P — (GST-P)” listed?

- Yes: Skip to step 6 of this guide

- No: Follow steps 3-5 of this guide, then proceed with step 6

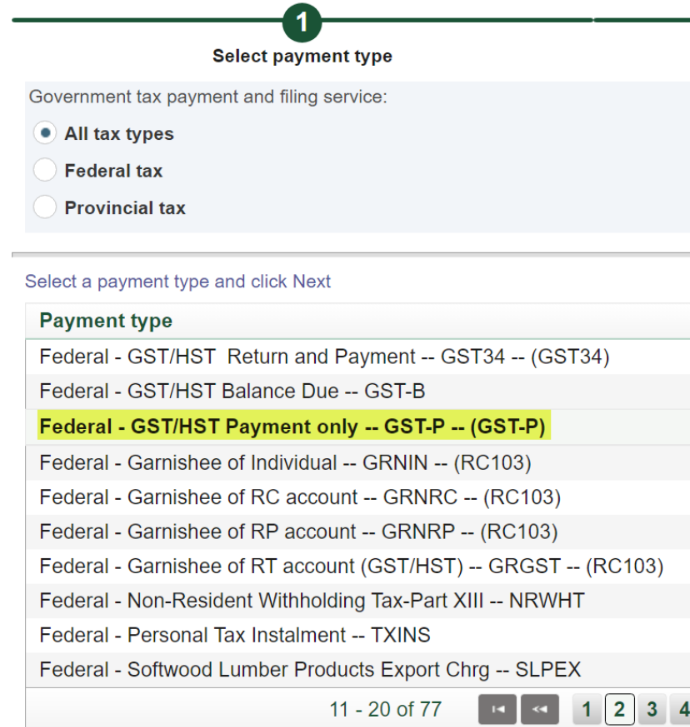

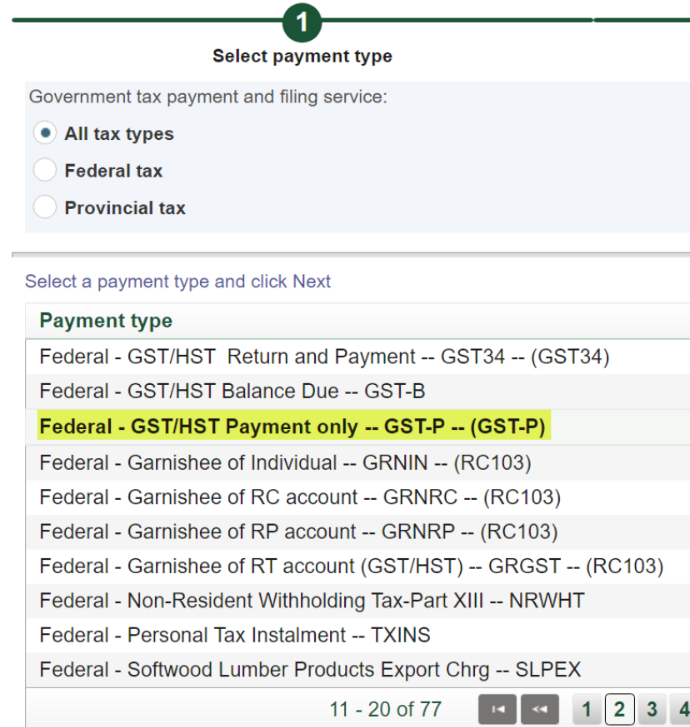

Step 4:

Select “Federal – GST/HST Payment only — GST-P — (GST-P),” then select “Next.”

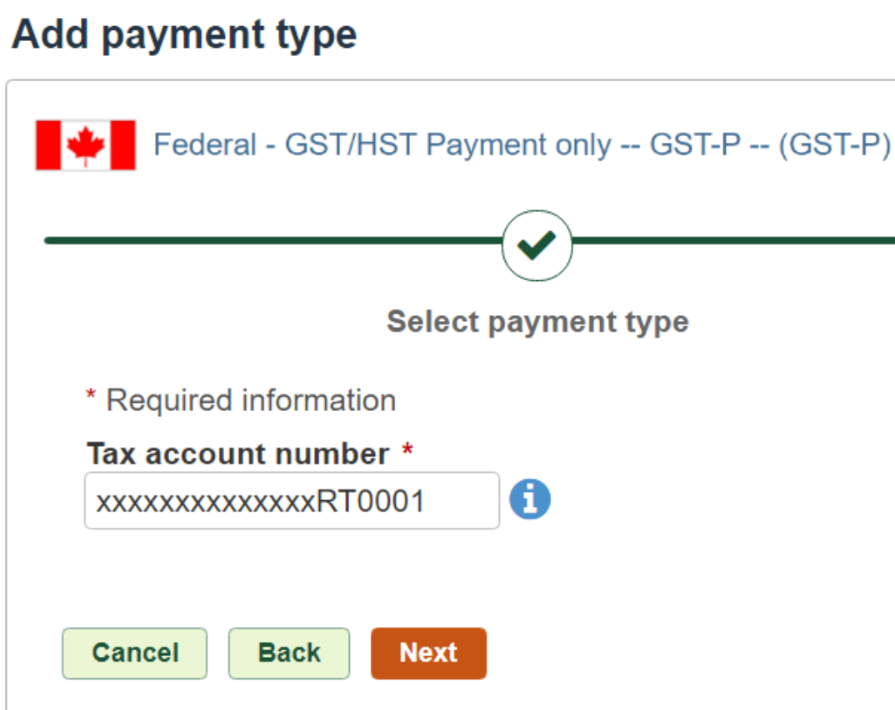

Step 5:

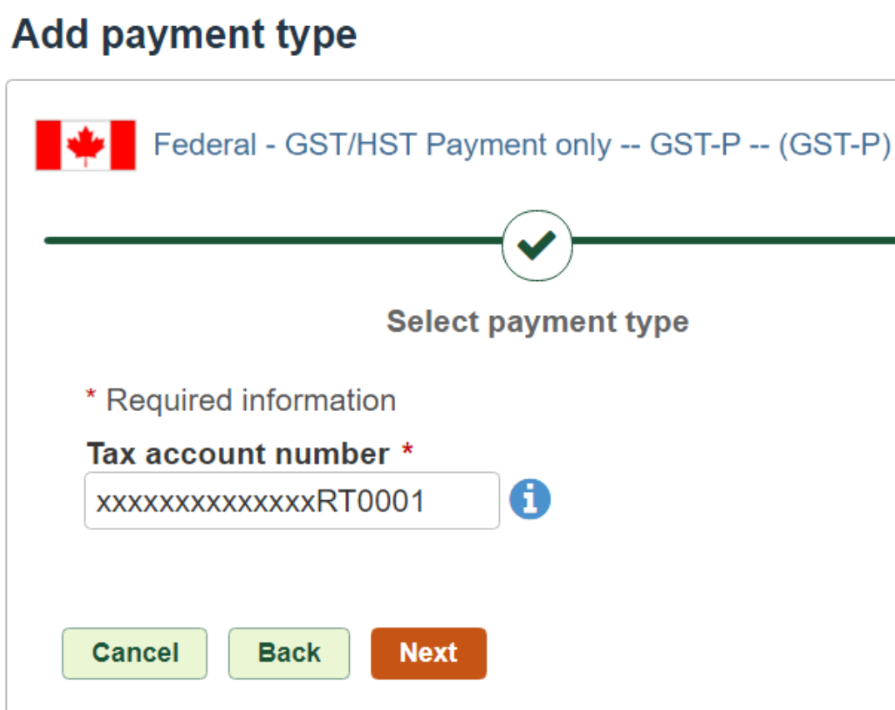

Enter GST/HST NUMBER – it contains 9 digits + RT + 0001 as shown below

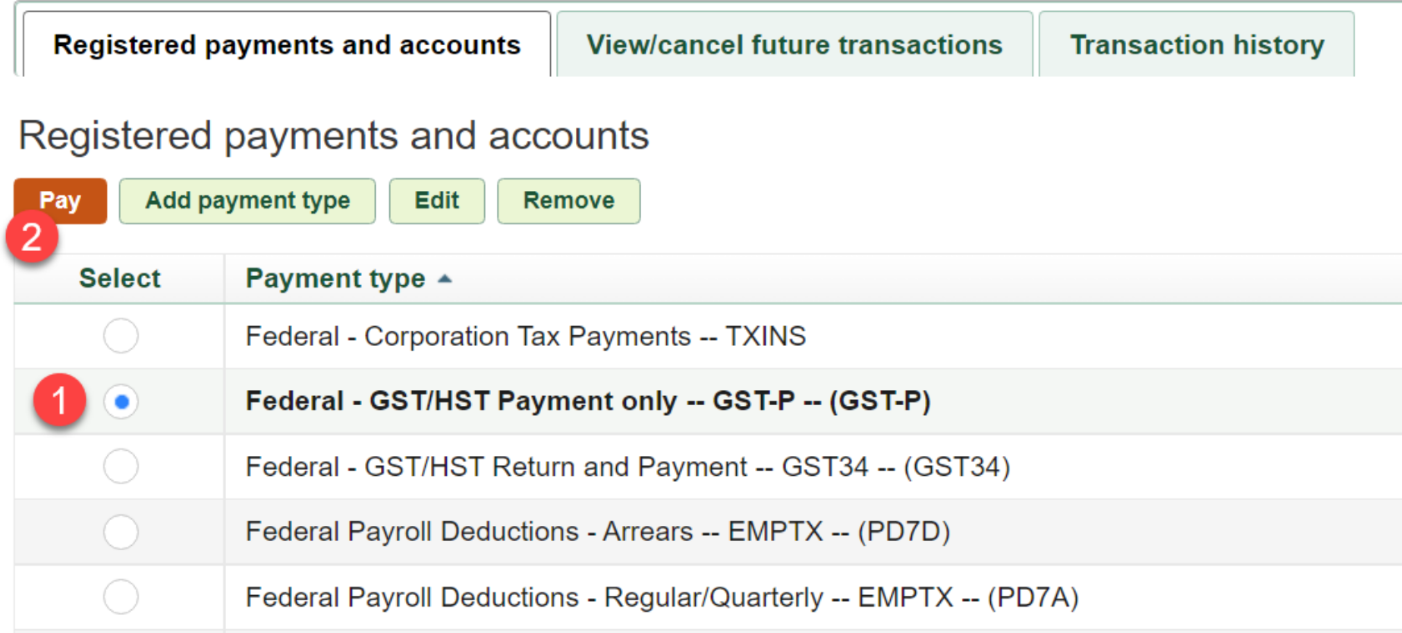

Step 6:

Select “Federal – GST/HST Payment only — GST-P — (GST-P)” and click “Pay”

Step 7:

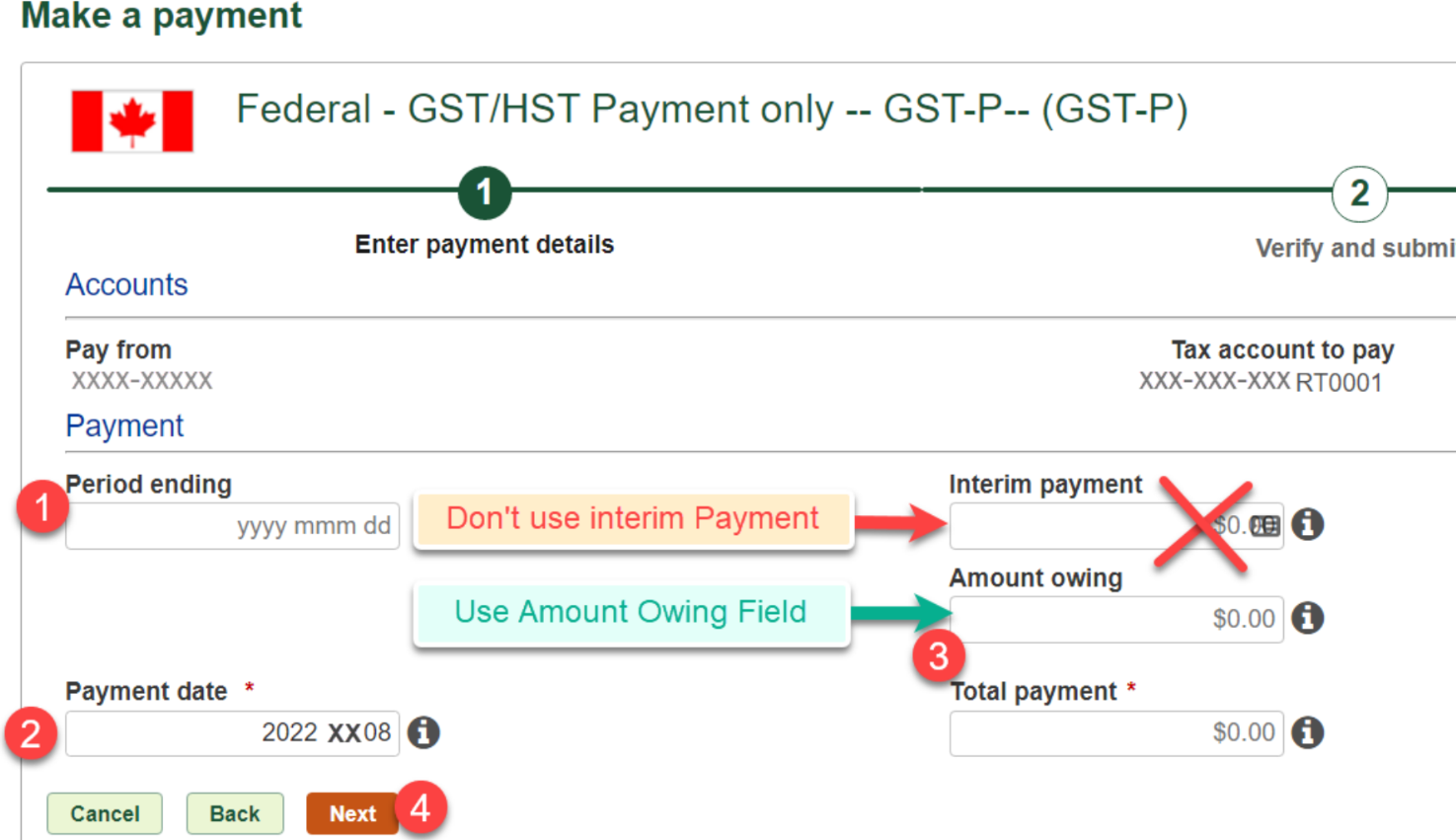

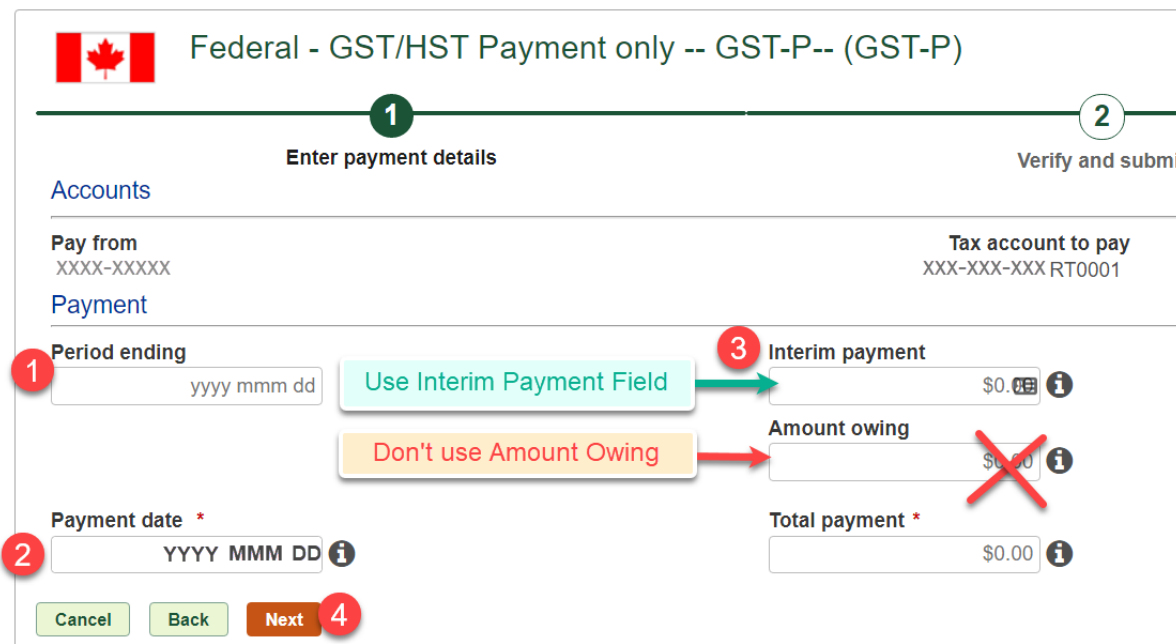

Fill out the payment form as follows:

- Period ending: This is your corporate year to which you are making this payment (Example: 20XX-12-31)

- Payment Date: This is the date you specify for the bank to process this payment

- Enter the amount due in the “Amount owing” field. Don’t use “Interim Payment”

- Click Next

Step 8:

Review information and click Submit

Step 9:

Once submitted, Print the confirmation sheet in PDF format and email it to us

How to Pay (GST/HST) in Installments Using Online Banking

Note: This process cannot be done using mobile banking or personal bank accounts

Step 1:

Sign into your financial institution’s online banking for business

Step 2:

Find the Tax Payment section according to your bank as indicated below.

Step 3:

Add “Federal – GST/HST Payment only — GST-P — (GST-P)” if needed

Is “Federal – GST/HST Payment only — GST-P — (GST-P)” listed?

- Yes: Skip to step 6 of this guide

- No: Follow steps 3-5 of this guide, then proceed with step 6

Step 4:

Select “Federal – GST/HST Payment only — GST-P — (GST-P),” then select “Next.”

Step 5:

Enter GST/HST NUMBER – it contains 9 digits + RT + 0001 as shown below

Step 6:

Select “Federal – GST/HST Payment only — GST-P — (GST-P)” and click “Pay”

Step 7:

Fill out the payment form as follows:

- Period ending: This is your corporate year to which you are making this payment (Example: 20XX-12-31)

- Payment Date: This is the date you specify for the bank to process this payment

- Enter the amount due in the “Interim payment” field. Don’t use “Amount owing”

- Click Next

Step 8:

Review information and click Submit

Step 9:

Once submitted, Print the confirmation sheet in PDF format and keep it for your reference

How Remit (Pay) Payroll Source Deductions to the CRA

Note: This process cannot be done using mobile banking or personal bank accounts

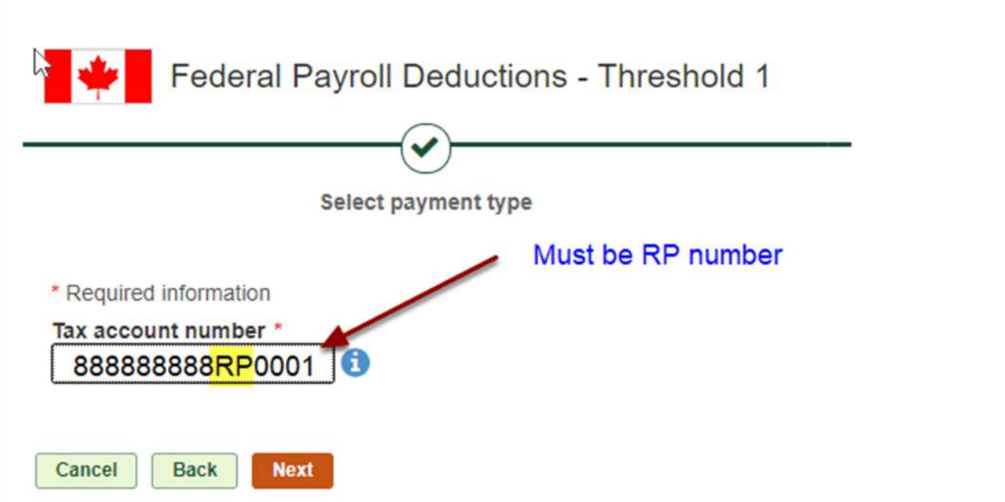

Step 1:

Sign into your financial institution’s online banking for business

Step 2:

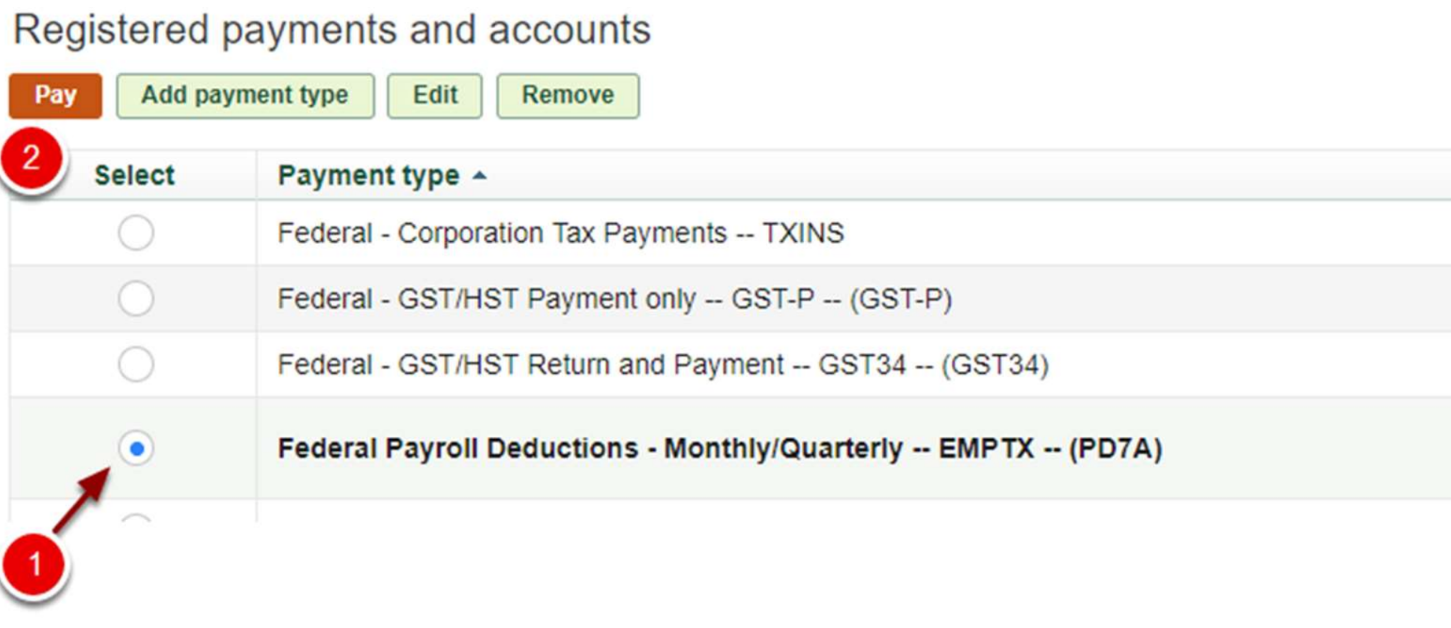

Find the Tax Payment section according to your bank as indicated below.

Step 3:

Add “Federal Payroll Deductions – Regular/Quarterly — EMPTX — (PD7A)” if needed

Is “Federal Payroll Deductions – Regular/Quarterly — EMPTX — (PD7A)” listed?

- Yes: Skip to step 6 of this guide

- No: Follow steps 3-5 of this guide, then proceed with step 6

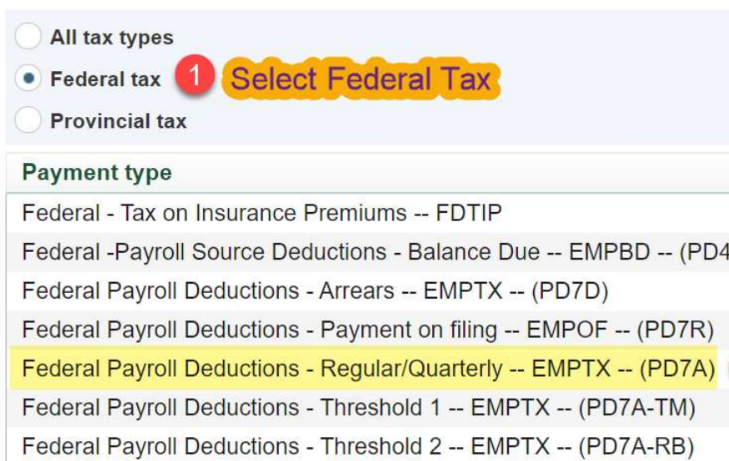

Step 4:

Select “Federal Payroll Deductions – Regular/Quarterly — EMPTX — (PD7A)”

Step 5:

Enter your 15-digit payroll number (RP number), then click “Next” and “Done”

Step 6:

After adding the payment type, select “Federal Payroll Deductions – Monthly/Quarterly — EMPTX — (PD7A)” click “Pay”

Step 7:

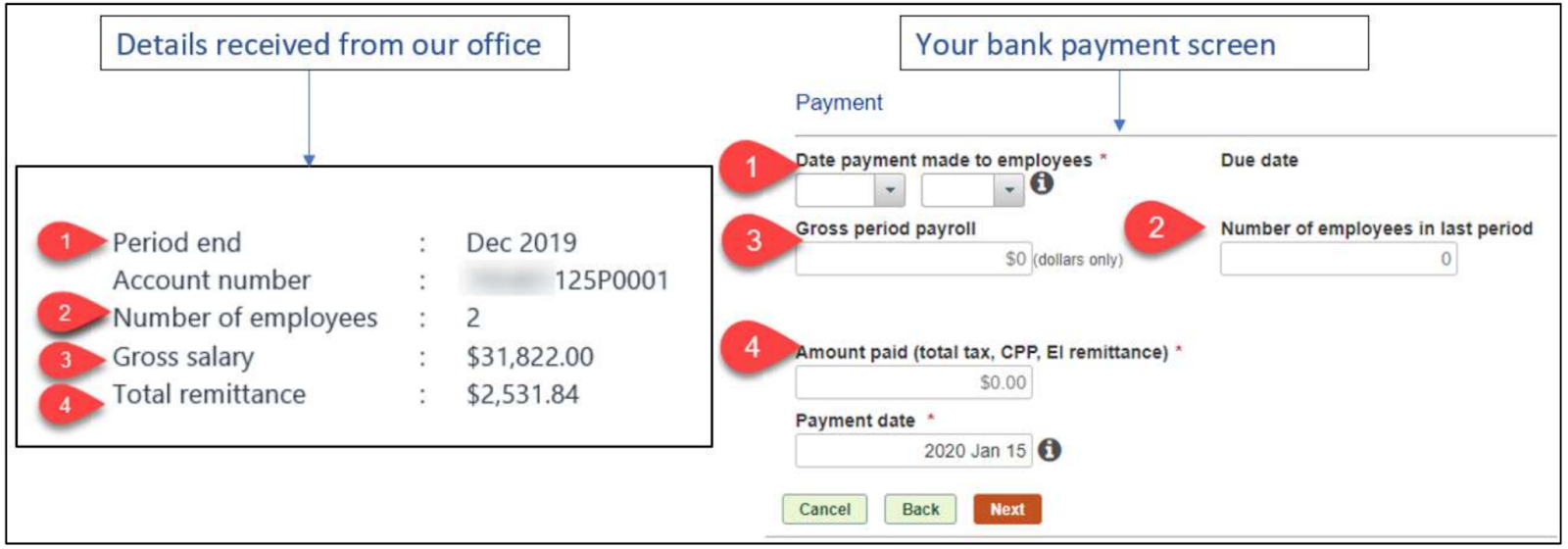

Check the “T4 Summary” email we sent you. Use it to complete your bank payment screen as shown below. Then, click “Next” and “Submit”

Step 8:

Print the confirmation sheet in PDF format and email it to us

How Remit (Pay) Payroll Balance Owing in Arrears to the CRA

Note

- This process cannot be done using mobile banking or personal bank accounts

- Do not combine your arrears payment with a current remittance. Instead, use only arrears or balance owing remitting options as shown in the steps below.

Step 1:

Sign into your financial institution’s online banking for business

Step 2:

Find the Tax Payment section according to your bank as indicated below.

Step 3:

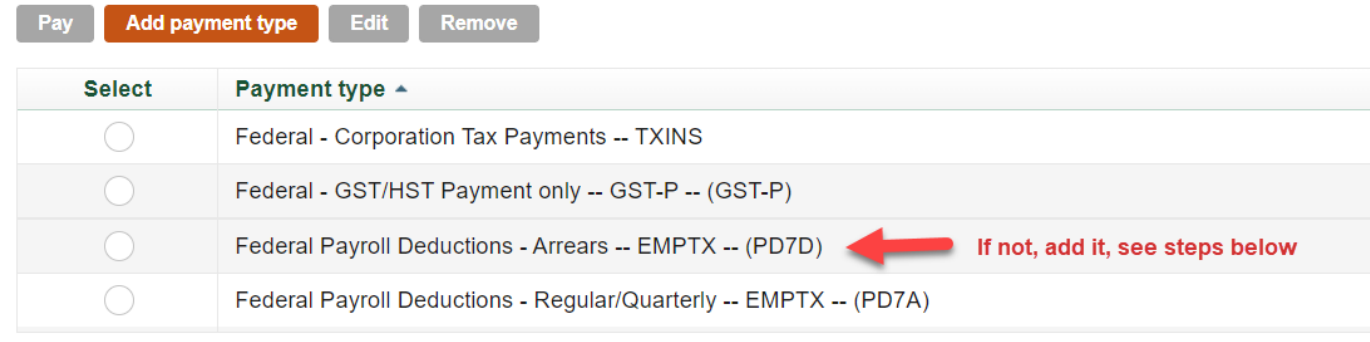

Add “Federal Payroll Deductions – Arrears — EMPTX — (PD7A)” if needed

Is “Federal Payroll Deductions – Regular/Quarterly — EMPTX — (PD7A)” listed?

- Yes: Skip to step 6 of this guide

- No: Follow steps 3-5 of this guide, then proceed with step 6

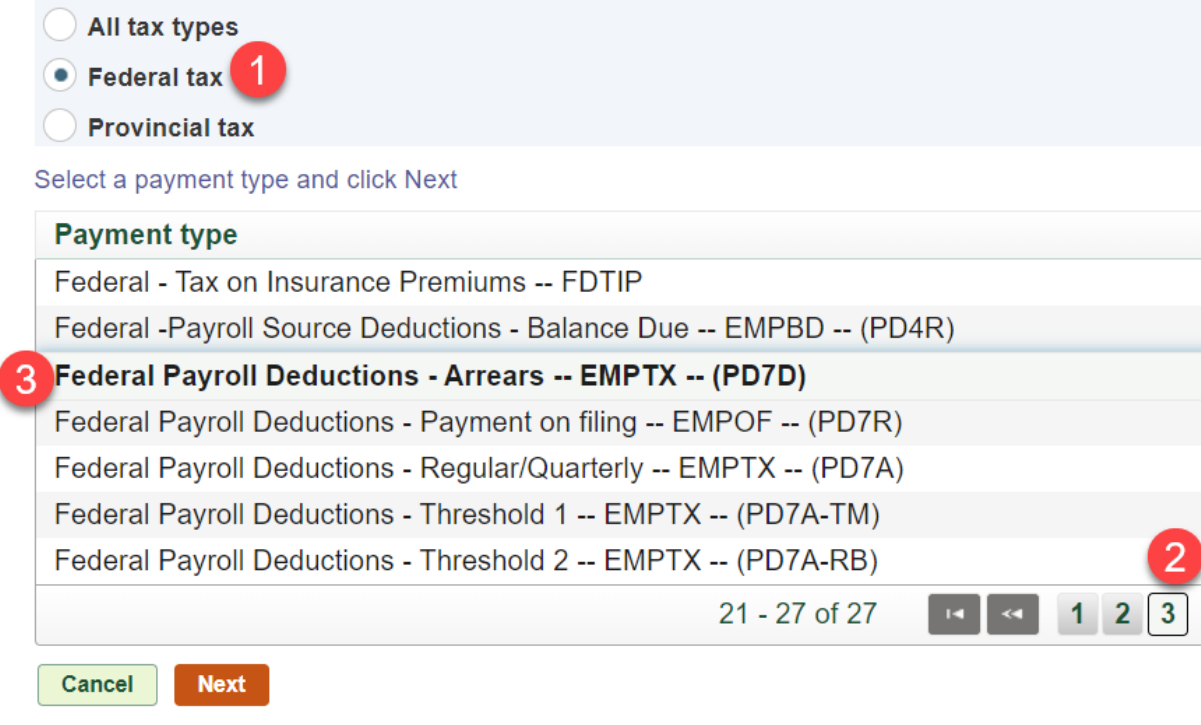

Step 4:

- Select Federal Tax

- Select “Federal Payroll Deductions – Arrears — EMPTX — (PD7A)”

- Click “Next”

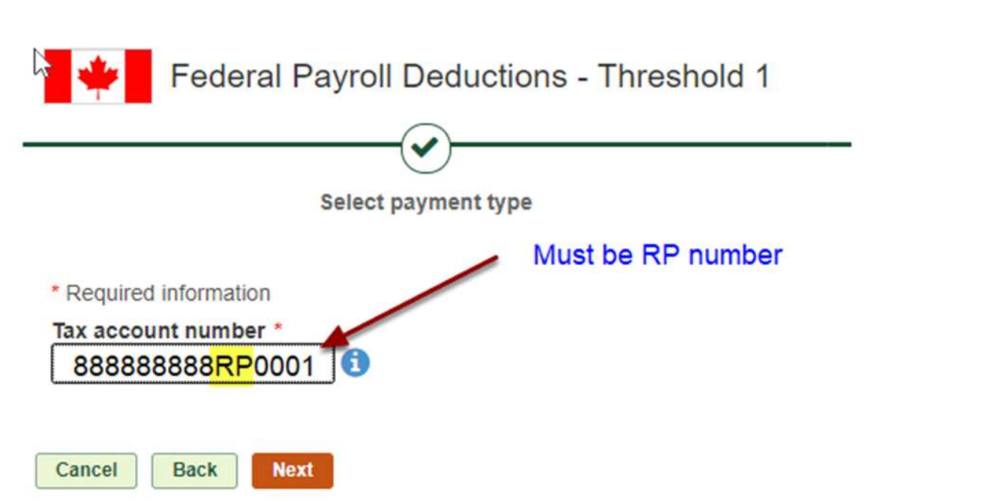

Step 5:

Enter your 15-digit payroll number (RP number), then click “Next” and “Done”

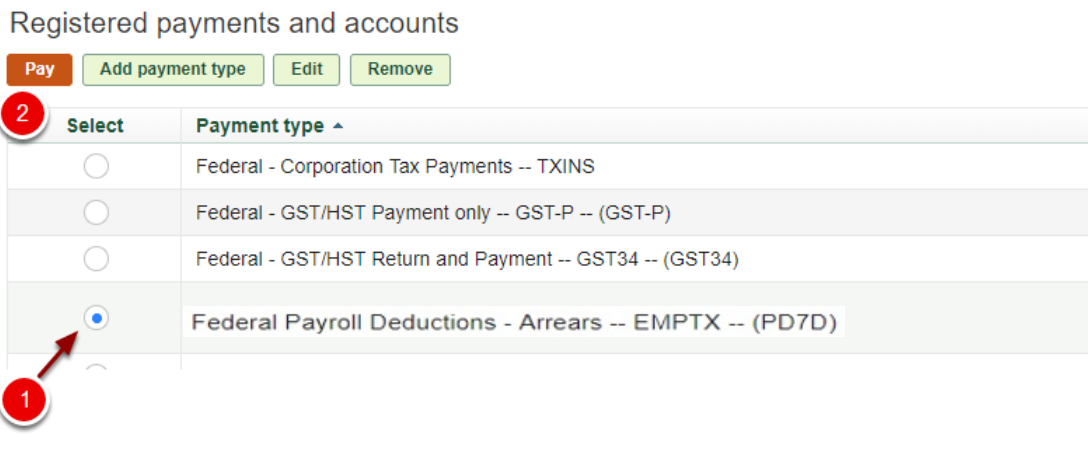

Step 6:

- Select “Federal Payroll Deductions – Arrears — EMPTX — (PD7A)”

- Click “Pay”

Step 7:

- Enter the amount to be paid

- Enter the Payment date

- Click “Next” then click “Submit”

Step 8:

Print the confirmation sheet in PDF format and email it to us